A snapshot of Navios Maritime Holdings’ fourth quarter earnings

Navios Maritime Holdings (NM) is a global seaborne shipping and logistics company. It’s focused on the transport and transshipment of dry bulk commodities.

March 11 2015, Updated 10:24 a.m. ET

Fourth quarter earnings

Navios Maritime Holdings (NM) is a global, vertically integrated seaborne shipping and logistics company. It’s focused on the transport and transshipment of dry bulk commodities including iron ore, coal, and grain. Navios Holdings reported its fourth quarter and full-year 2014 financial results on February 19, 2015.

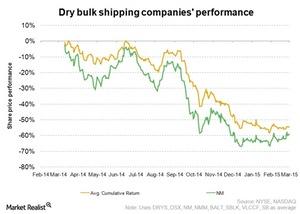

Since then, the company’s stock recorded a 1.5% growth to date. Other shipping companies include Diana Shipping (DSX), DryShips (DRYS), Safe Bulkers (SB), and Navios Maritime Partners LP (NMM). They’re due to report earnings in March. They recorded a 8.6%, 11.9%, +0.5%, and 0% decline in the same period.

In this series, we’ll discuss the highlights from the fourth quarter earnings. This includes Navios Holdings’ chartering strategy. It led to higher revenue and net income. It also had a strong balance sheet and diversified investment vehicles.

While tracking Navios Holdings and its peers, we’ll also look at the performance of associated ETFs like the PowerShares DB Oil Fund ETF (DBO), the iShares S&P Global Consumer Staple ETF (KXI), and the iShares FTSE/Xinhua China 25 Index ETF (FXI). Oil price movements, China’s economy, and consumer consumption levels affect Navios Holdings’ performance.

Stakes in peer companies

Navios Holdings owns a 20% stake in Navios Maritime Partners. It owns a 46.4% stake in Navios Maritime Acquisition Corp. (NNA). Navios Maritime Partners is a master limited partnership. It helps Navios Holdings monetize assets with long-term chartered contracts. Navios Maritime Acquisition Corp. is engaged in tanker shipping. It faced headwinds due to a sluggish business environment.

Any improvement in the performance of these two affiliates will result in higher equity income and higher market value of investment. According to Bloomberg estimates, these two affiliates contribute $4.50 per share. This is ~55% of the charter-free net asset value of Navios Holdings—at current asset prices.