Katie Dale

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Katie Dale

Scorpio Tankers adopts a shift in charter mix

For the third quarter of 2014, the charter hire expense increased $1.1 million to $32.9 million, from $31.9 million in the year ago quarter.Energy & Utilities Why Frontline is on the verge of bankruptcy

Industry analysts suggest that investors should avoid Frontline because of the bankruptcy risk. Currently, the company is facing bankruptcy. This is led by the $190 million bond that’s due in April 2015.

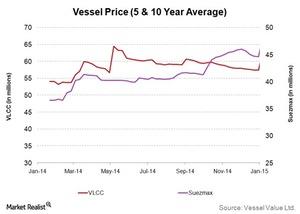

Five-year and ten-year VLCC prices increase

With faster deliveries and employment of vessels, secondhand vessels tend to reflect industry participants’ expectations for medium-term fundamentals.Energy & Utilities 5-year-old and 10-year-old VLCC prices stay at consistent levels

Since secondhand vessels can be delivered within a few months, they tend to reflect industry participants’ expectations for medium-term fundamentals and rates, unlike newbuilds, for which two years of delivery time is mandatory.

Why Noodles and Company has short and long-term goals

Noodles & Company (or NDLS) has a few initiatives and tactics to drive short-term traffic. It also drives longer-term brand and customer loyalty building.Consumer Why it’s important to understand Noodles and Co.

Noodles & Company (or NDLS) was founded in 1995. It’s a fast-casual restaurant chain that serves classic noodle and pasta dishes.

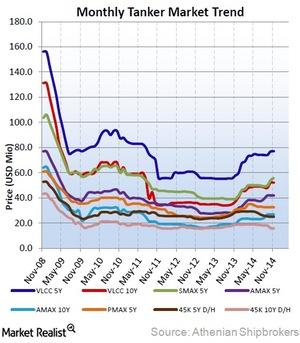

5- and 10-year VLCC and Suezmax weekly prices on the run-up

Weekly vessel values have been on the rise, with positive week-over-week and significant year-over-year growth.

5- and 10-year VLCC Prices Higher in February

Five-year VLCC prices in February increased to $80.9 million from $80.7 million in January. Ten-year VLCC prices fell to $52.2 million from $52.8 million.

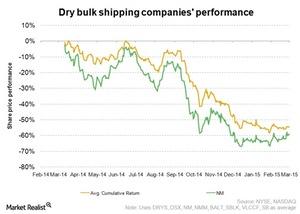

A snapshot of Navios Maritime Holdings’ fourth quarter earnings

Navios Maritime Holdings (NM) is a global seaborne shipping and logistics company. It’s focused on the transport and transshipment of dry bulk commodities.

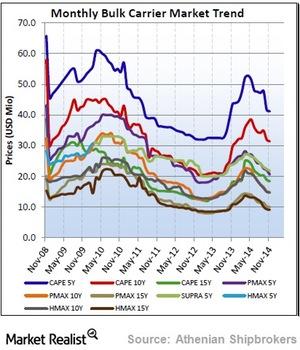

5-year and 10-year ship prices for dry bulk companies

Vessel prices are very close to bottom levels that occurred back in the period from December 2012 to January 2013.