Why Low Labor Productivity Could Affect GDP Growth

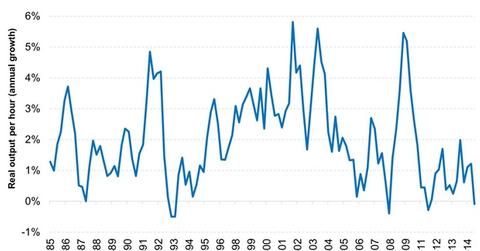

Labor productivity growth has slumped to a negative. The 30-year average is 2%. However, this average has been quite volatile.

March 19 2015, Updated 1:06 p.m. ET

In the fourth quarter of last year, U.S. productivity, defined roughly as output per hours worked, fell 1.8%, as the labor force added workers faster than production increased output. While investors should not lose sleep over one bad number—productivity is a notoriously volatile indicator—unfortunately the negative reading was consistent with a longer-term weakening trend. For all of 2014 productivity was basically flat. Since exiting the recession in 2009 productivity has averaged about 1.30%, a full percentage point below its long-term average.

Market Realist – Low labor productivity could affect GDP growth.

As we mentioned in Part 1 of this series, growth in the workforce and the productivity of that workforce determine the economy’s long-term growth. In this part of the series, we’ll tackle the latter.

The graph above shows the annual growth in labor productivity over the last 30 years. As you can see, labor productivity growth has slumped to a negative. The 30-year average is 2%. However, this average has been quite volatile.

If lower productivity is here to stay, it will affect future output levels, which, in turn, will negatively affect stock markets (SPY)(VOO).

Usually, wages align with productivity. This trend has led to poor wage rates lately, which have led to poor consumption in the US economy since the financial crisis. Poor consumption could negatively affect consumer-related segments like retail (XRT), consumer staples (XLP), and consumer discretionary (XLY).

Read on to the next part of this series to learn about the effects of technology on productivity over the last few decades.