Key iron ore indicators to consider

It’s important to look at iron ore indicators collectively because they give clues about the direction of iron ore prices.

March 10 2015, Updated 1:47 a.m. ET

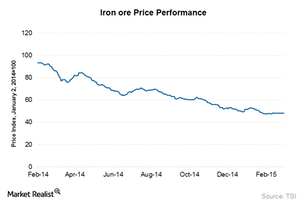

Price performance

Iron ore prices have continued to decline well into 2015 after having fallen ~49% in 2014. They touched a low of $61.1 per ton and have not moved much higher since.

Demand side

Of all the world economies, China consumes the most iron ore and is responsible for about 60% of seaborne iron ore imports. Since China is the single most important market as far as demand dynamics are concerned, factors related to this economy affect the iron ore industry most significantly. Other important countries to watch out for are Japan and European nations. To learn more, read Must-know: Iron ore use and stage of development.

Supply side

Rio Tinto (RIO), BHP Billiton Limited (BHP), Australia’s Fortescue Metals Group, and Brazil’s Vale SA (VALE) significantly impact the supply side of the equation for iron ore. Combined, these companies contribute more than 70% of seaborne iron ore supplies.

Iron ore indicators

In this series, we’ll discuss various demand and supply indicators you can track to get a sense of where the iron ore industry’s performance is headed.

On the demand side, we’ll consider influences like China’s inventory levels, steel production, iron ore imports, and PMI (or purchasing managers’ index). We’ll also talk about factors such as the credit situation and the real estate market. Plus, we’ll look at how lower freight rates and weaker currencies impact company performance. Lastly, we’ll provide an outlook that keeps these iron ore indicators in view.

It’s important to look at iron ore indicators collectively because they give clues about the direction of iron ore prices. Ultimately, these indicators will also tell you about the share prices of Rio Tinto, BHP, Vale, Cliffs Natural Resources (CLF), similar companies, and the iShares MSCI Global Metals & Mining Producers ETF (PICK). BHP, RIO, and Vale form 33.7% of this ETF’s holdings. The SPDR S&P Metals & Mining ETF (XME) also invests in some of these stocks.