Why is the Freescale–NXP merger premium so low?

The companies were asked about the takeover premium and the background to the transaction on the conference call, but they refused to comment.

Nov. 20 2020, Updated 12:22 p.m. ET

Could this deal get competitive?

For merger arbitrage professionals, competitive deals can make your quarter. If you get two companies bidding against each other, a 1% gross spread can easily become 10% by the time everything is said and done. Could the Freescale–NXP merger get broken up by an interloper?

Why was the takeover premium so low?

Freescale Semiconductor (FSL) was trading at $34.50 before the story broke that they were in talks. Based on NXP Semiconductors’ (NXPI) pre-announcement price of $84.90, the takeover price amounts to $36.14. This is a takeover premium of only 5%, which is very, very low. The companies were asked about the takeover premium and the background to the transaction on the conference call, but they refused to comment.

Arbitrageurs will go straight to the background section of the proxy the second it’s released.

Deal comparisons

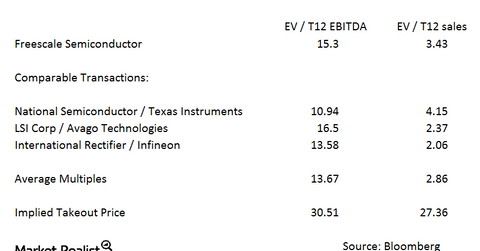

Arbitrageurs will often compare the price the acquirer is paying to other deals in the same industry. This is always more art than science, since no two companies are alike, interest rate environments change, etcetera. However, we do have a few deals we can look at.

In the past few years, there have been a few large transactions in the semiconductor space:

- National Semiconductor – bought by Texas Instruments (TXN)

- LSI Corporation – bought by Avago (AVGO)

- International Rectifier – bought by Infineon Technologies AG (IFFNY)

The chart above shows the multiples. The average multiple of trailing-12-month EBITDA (earnings before interest, taxes, depreciation, and amortization) was 13.7x. Freescale is being taken out at 15.3x, which is somewhat rich on a enterprise value/EBITDA basis.

Freescale just reported a great quarter and the forward estimates for the stock were taken up. So trailing-12-months isn’t necessarily the best comparison. Valuing Freescale on the average 13.7 multiple gives it a fair price of $30.51.

The average multiple of trailing-12-month revenues was 2.86x. Freescale is being taken out at 3.43x sales, which is, again, rich compared to the comparisons. Valuing Freescale at 2.86x gives a fair price of $27.36.

This may explain why the takeover premium was so low—because Freescale was already richly valued in the marketplace. If you use 2015 estimates for Freescale’s EBITDA, it comes in at 13.5x, more or less in line with the comparisons. It’s still rich on an enterprise value to 2015 sales metric.

Other merger arbitrage resources

Other important merger spreads include the Hospira–Pfizer deal. The Hospira (HSP) and Pfizer (PFE) merger is also set to close in 2H15. For a primer on risk arbitrage investing, read Merger arbitrage must-knows: A key guide for investors.

Investors who are interested in trading in the semiconductor sector should look at the VanEck Vectors Semiconductor ETF (SMH).