Why are some energy companies more leveraged than others?

In the past five years, many of the upstream and integrated energy companies have increased their debt. Some are more leveraged than others.

March 19 2015, Updated 5:07 p.m. ET

The effect of leveraging

So far in this series, we’ve described how bond investments have strutted up in recent times and why increased leverage can be dangerous for energy upstream and integrated companies.

The drop in oil prices will reduce cash flow for producers, prompting them to spend less money on exploring and drilling new wells. That, in turn, will reinforce the drop in revenues, profits, market value, and liquidity. Read our article Is a crude oil price trend forcing energy companies to bite the bullet? to find out more about energy upstream companies’ capex (capital expenditures) and production plans.

Which companies are more leveraged than others?

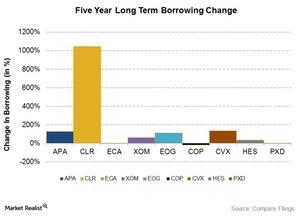

In the past five years, many of the upstream and integrated energy companies have increased their debt. Some are more leveraged than others. Of the seven oil and gas exploration and production companies and two integrated companies that we’re covering, seven have increased long-term borrowings. In a later part of this series, we’ll take a look at the debt of one company, Laredo Petroleum (LPI).

On average, long-term borrowings for these companies have increased 167% in the past five years. As you can see in the above graph, Continental Resources’ (CLR) borrowings have increased the most, by more than ten times during this period. ConocoPhillips (COP), on the other hand, reduced its long-term borrowings by 17%. Exxon Mobil (XOM) and Chevron Corporation (CVX), the integrated majors, have also increased long-term borrowings during this period. XOM and CVX make up 28% of the Energy Select Sector SPDR ETF (XLE).

Energy bonds are losing value

High-yield energy bonds are losing value. Since July, $40 billion deflated out of the value of energy bonds as yields rose. If yield rises, the value of the bond falls. Higher yield indicates increased riskiness of the bonds.

The oil and gas industry borrowed $786 billion over the last five years to fund drilling and acquisitions. Such huge borrowings were made under the assumption that relatively high oil prices would persist. Since the oil bubble burst, there’s a growing fear over repayment, debt covenant violation, and even bankruptcies for some low market cap energy upstream companies.

In the next parts of this series, we’ll look in detail at the debt structures of each of these companies.