Understanding Freeport’s Capital Allocation Strategy

As copper market conditions have improved, companies have also taken another look at their capital allocation strategies.

Feb. 28 2018, Updated 7:31 a.m. ET

Freeport’s capital allocation

As copper market conditions have improved, companies have also taken another look at their capital allocation strategies. Only a couple of years back, debt reduction was the sole priority for miners, as commodity prices were hovering near multiyear lows. Now, as prices have bounced back sharply, miners have been exploring other ways to allocate capital—including returning cash to shareholders.

Cash flows

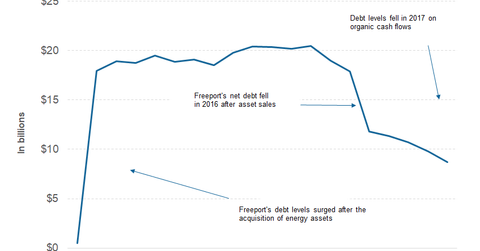

Freeport-McMoRan (FCX) has been using its surplus cash flows to pursue further debt reduction. During their 4Q17 earnings call, Kathleen Quirk, Freeport’s CFO, said, “During the fourth quarter, we repaid $1.7 billion in debt and that include – included the early redemption of $617 million of senior notes due 2020 and open-market repurchases of $74 million of notes due in 2018.”

Freeport listed several brownfield opportunities at its American mines. However, Richard Adkerson, Freeport’s CEO, said during the company’s 4Q17 call, “We’re going to be very disciplined about all these projects. They’re big. They’re low-risk. But there’s still risk to the global economy as we all know and we’re going to keep our finger on it, see how it’s progressing, how China is doing, how the rest of the world is doing.”

Dividend

Meanwhile, Freeport reinstated its dividend earlier this year. The company suspended its dividend program in 2015 in response to falling commodity prices (ANTO). Anglo American (AAL-L) and Glencore (GLEN-L) also suspended their dividends that year. Debt reduction could remain Freeport’s priority for the next two years, as the growth projects that it listed wouldn’t require much capital in the near term.

In the next part of this series, we’ll look at Southern Copper’s (SCCO) capital allocation strategy.