Brinker International’s Key Costs of Operations

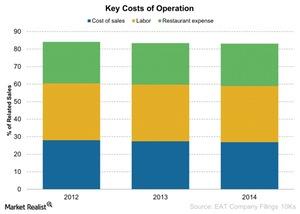

Brinker incurs key costs of operations to run its company-owned restaurants, including cost of sales, labor and related costs, and rent and other costs.

April 7 2015, Updated 3:07 p.m. ET

Key costs of operations

Brinker International (EAT) incurs a few key costs of operations to run its company-owned restaurants. Bear in mind that these costs exclude franchises in which the franchisee bears these costs and pays a royalty to Brinker International.

The key costs of operation include the following three costs:

- cost of sales

- labor and related costs

- rent and other costs

These costs accounted for 83.1% of Brinker International’s revenue in fiscal year 2014. These same costs accounted for about 83.9% of Darden Restaurants’ (DRI) revenue.

Cost of sales

Brinker International has managed its food cost tightly, which has resulted in a cost of sales decline of 26.5% in 2014 from 27.41% as a percentage of sales year-over-year. Cost of sales includes food costs such as meat, seafood, produce, and dairy.

During 2013 and 2014, several restaurants, including Darden Restaurants (DRI), Texas Roadhouse (TXRH), and McDonald’s (MCD), were affected by rising beef prices. The price increase in beef was driven by unfavorable weather conditions in the United States.

The Consumer Discretionary Select Sector SPDR (XLY) holds about 10% of restaurants, including about 0.3% of DRI.

Labor and related costs

Labor and related expenses include wages, compensation plans, and incentives. Labor and related costs accounted for 32.08% as a percentage of sales to the company in fiscal year 2014. The company has tightly managed these costs as well as labor costs at 32.36% in 2013 and 32% in 2012. There is a looming issue of a minimum wage increase in the United States, which can make things worse for all restaurants if it goes into effect.

Rent and other costs

Rents and related expenses include operating supplies, utilities, insurance, and rent. These expenses accounted for 24.17% of Brinker’s sales in 2014. These costs are usually fixed. Management’s efforts to control costs have paid off with EBITDA (earnings before interest, taxes, depreciation, and amortization) steadily rising. We’ll discuss EBITDA growth in the next part.