Analyzing Capital One’s business segments

Capital One (COF) can be understood best by breaking it into different business segments—Credit Card, Consumer Banking, and Commercial Banking.

March 5 2015, Published 9:27 a.m. ET

Capital One’s main business segments

It’s often said that the easiest way to solve a complex problem is to break it into smaller, understandable parts. Similarly, the easiest way to analyze and understand a company is to break it into smaller parts.

Capital One (COF) can be understood best by breaking it into different business segments. Its three main business segments are:

- Credit Card

- Consumer Banking

- Commercial Banking

Credit Card segment

This is the bank’s legacy business. In this business, the bank offers various credit cards to cater to the needs of individuals, small businesses, and corporates.

Other prominent banks are JPMorgan Chase (JPM) and Citibank (C). Monoline credit card providers Visa and MasterCard are also dominant.

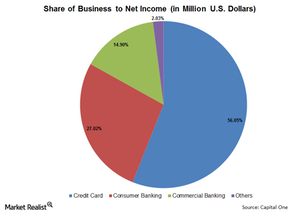

The Credit Card segment is Capital One’s largest business in terms of revenue and net income. The segment accounted for 56.05% of the bank’s total net income in 2014.

Consumer Banking segment

This is Capital One’s second business. In this business, the bank offers a variety of different mass-market and customized financial products for individuals, families, and communities. These products include deposits, loans, and other products.

Other dominant banks are Wells Fargo (WFC), U.S. Bank (USB), and PNC Bank (PNC). These three banks account for 12.93% of the Financial Select Sector SPDR (XLF).

This segment accounted for 27.02% of Capital One’s net income in 2014.

Commercial Banking segment

This is Capital One’s newest business. In this business, the bank offers loans and other products for corporations. Recently, the bank has been focusing on this segment. It provides many opportunities for Capital One.

In the next parts of this series, we’ll look at each of the three segments in more detail.