Making sense of an insurer’s liabilities

Policyholder liabilities, or policyholder reserves, represent the future claims that may arise for the pool of policies the insurer writes.

Nov. 19 2019, Updated 6:12 p.m. ET

Policyholder liabilities

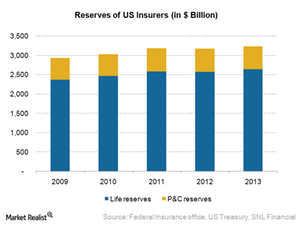

The most important class of liabilities for an insurer is the policyholder liabilities, also known as policyholder reserves. These liabilities represent the future claims that may arise for the pool of policies the insurer writes. Growth in policyholder liabilities is considered as an important metric for business expansion and is also an important factor in calculating capital requirements.

The above chart shows the consistent growth in liabilities of US insurers. One can invest in US insurers through the SPDR S&P Insurance ETF (KIE).

Reserving for P&C insurance

Because claims in the P&C business rely strongly on natural occurrences, they can be volatile. This makes reserving a crucial factor. The claims reserve reported by P&C insurers represent the claims reported but not settled, as well as claims incurred but not reported, also known as IBNR. P&C providers include AIG (AIG), Ace (ACE), Travelers (TRV), and Allstate (ALL).

Because these reserves are computed based on prior experience and estimates, they are updated periodically. This results in the reserves being released, if more reserves were kept earlier, or strengthened, if less reserving took place in prior periods. Prior year reserve releases flow through the income statement and are included as an item in underwriting profit. It is a common practice to adjust the combined ratio—or the way to analyze the underwriting performance of a P&C insurer—for such impacts.

Interest rates impact reserves

In simple terms, insurance liabilities are the present value of future claims that may arise due to underwriting the contracts. This present value is obtained by discounting the estimated future claims using an appropriate discount rate. This results in a higher value of liabilities in a period of low interest rates, such as the current scenario. This in turn implies the insurer must meet higher capital requirements.