Travelers Companies Inc

Latest Travelers Companies Inc News and Updates

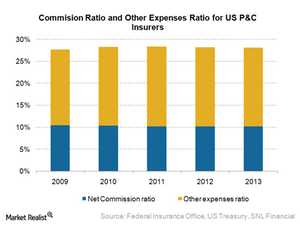

How cost structures and distribution channels impact profit

As customers use Internet-based aggregators to purchase insurance policies, insurers use online sales to interact directly with customers and reduce costs.

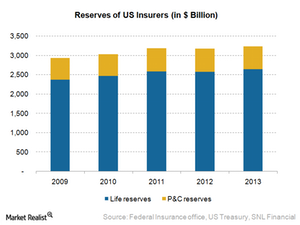

Making sense of an insurer’s liabilities

Policyholder liabilities, or policyholder reserves, represent the future claims that may arise for the pool of policies the insurer writes.

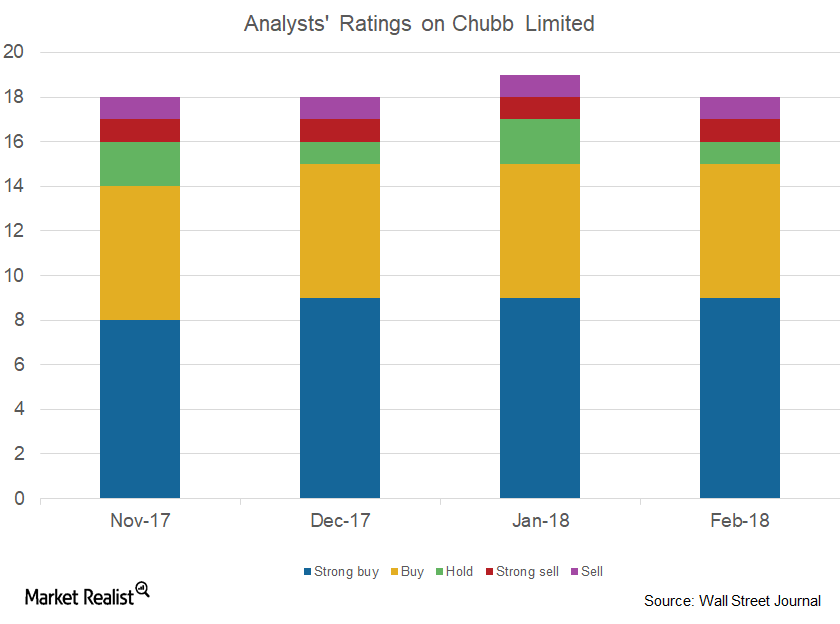

How Analysts Are Rating Chubb

Chubb (CB) is tracked by 18 analysts in February 2018. One analyst has recommended a “sell” for the stock, and one has recommended a “hold.”

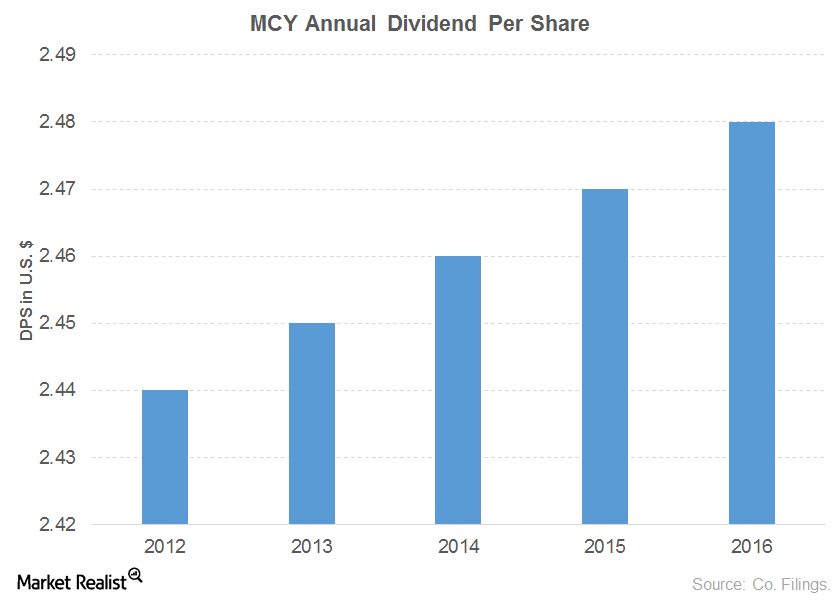

The Top Dividend-Growing Financial Sector Stocks

Mercury General (MCY) has consistently recorded revenue growth since fiscal 2011, except for a minor decline in fiscal 2015

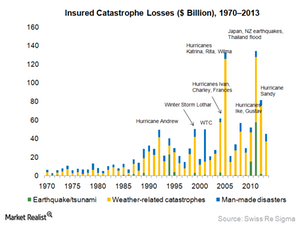

A Closer Look at the Costliest Catastrophes

Hurricanes Sandy, Ike, and Andrew remain near the top of the list of the costliest catastrophes in terms of insured losses.

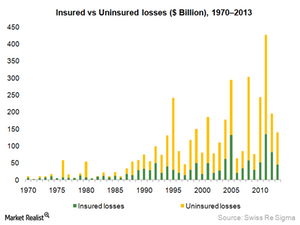

Making Sense of Economic and Insured Losses

Insured losses are the ones that impact the profitability of insurance companies.

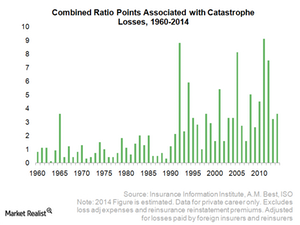

How Catastrophes Impact a P&C Insurer’s Combined Ratio

The percentage points for catastrophe losses in the combined ratio have increased in recent years.

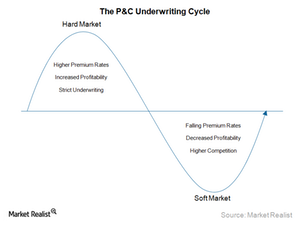

How Underwriting Cycles Impact the Top Line and the Bottom Line

The underwriting cycle moves between hard and soft market conditions, which have different sets of characteristics that determine the profitability of the insurance industry.

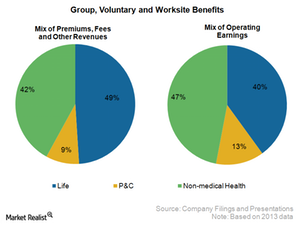

MetLife is a key player in the US group insurance business

MetLife is the market leader in the Large market with ~30% of the market share, while its market share is slightly above 5% in the Middle market.