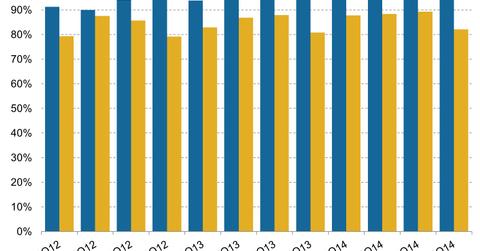

Hotel occupancy is way up at Wynn Macau and Wynn Las Vegas

WYNN’s hotel occupancy increased at Macau and Las Vegas in 4Q14. Macau had 98.6% and Las Vegas had 82.1% compared to 96.7% and 80.8%, respectively, in 4Q13.

Nov. 27 2019, Updated 7:19 p.m. ET

Hotel occupancy rate

Wynn Resorts’ (WYNN) hotel operation contributes ~10% to its overall revenues. The indicators for gauging hotel performance are occupancy rate, average daily rate (or ADR), and revenue per available room (or RevPAR).

In this part, we’ll discuss all these indicators and their impact on Wynn Resorts (WYNN). These indicators are important for casino players such as Wynn Resorts (WYNN), Las Vegas Sands (LVS), MGM Resorts (MGM), and Melco Crown Entertainment (MPEL).

A good way to have a diversified portfolio in the leisure space is to invest in ETFs such as the Consumer Discretionary Select Sector SPDR Fund (XLY) and the VanEck Vectors Gaming ETF (BJK). WYNN comprises ~7% of BJK and ~1% of XLY.

The above chart shows that WYNN’s average hotel occupancy levels increased both at Macau and Las Vegas in the fourth quarter of 2014. WYNN’s 4Q14 average occupancy stood at 98.6% for its Macau operations and 82.1% for its Las Vegas operations, compared to 96.7% and 80.8%, respectively, in the same quarter last year.

Revenue per available room

In the fourth quarter of 2014, WYNN’s ADR stood at $332, a 5.4% increase from $315 reported in the fourth quarter of 2013. RevPAR rose 7.9% to $328 in the fourth quarter of 2014 from $304 in last year’s fourth quarter.

ADR is calculated by dividing total room revenue, including the retail value of promotional allowances less service charges, if any, by total rooms occupied, including complimentary rooms.

RevPAR is the most important of all the performance metrics used in the hotel industry since it captures both room rates and occupancy levels. RevPAR is calculated by dividing total room revenue, including the retail value of promotional allowances less service charges, if any, by total rooms available. In short, RevPAR is occupancy rate times ADR.

Key takeaways from the 4Q14 earnings call

Stephen A. Wynn, chairman and CEO (chief executive officer) of WYNN, said, “The occupancy was high, because we only have 1,000 rooms in Macau, and therefore, we still had occupancy. It was more of our mass occupancy, a little more than VIP occupancy, but the hotel was full.”