What impacts an insurer’s profits?

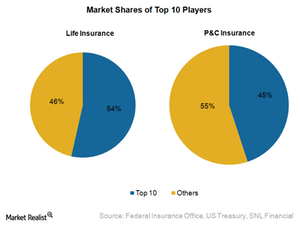

In 2013, the top ten life and health insurance companies had just above 50% market share in terms of direct premiums written.

Nov. 19 2019, Updated 6:17 p.m. ET

How an insurer makes money

An insurer provides coverage against financial loss due to unanticipated events. In order to earn a profit, an insurer creates a portfolio of policies in which the probabilities of these events occurring are not correlated. An insurer must pay claims for only a portion of the policies in the portfolio.

When a payout is less than the premium received (along with the expenses incurred to run operations), it results in a profit for the insurer. This is known as underwriting profit, which we’ll discuss in detail in the next article.

Factors impacting profit

Insurers cover a broad spectrum of risks including life, health, and risks to property. Consequently, the business drivers will vary depending on the type of contract. For example, life insurers write contracts that have significantly longer durations. Their concerns include managing assets in the long term to match the expected claims that may arise.

For P&C insurers, natural catastrophes have a significant impact on their profitability. Apart from this, the level of competition in the insurance industry also determines the profitability of the players.

Impact of competition

The insurance industry, represented by the SPDR S&P Insurance ETF (KIE), has a high degree of competition, primarily due to the commodity nature of the products. In 2013, the top ten life and health insurance companies had just above 50% market share in terms of direct premiums written. These companies include MetLife (MET), AFLAC (AFL), and Unam (UNAM).

For P&C insurers in the top ten bracket, including Allstate (ALL) and Travelers (TRV), the corresponding figure was less than 50%. So, the operating performance of an insurance company depends significantly on its product mix and operating cost structures. Maintaining margins requires product innovation as well as products with lower regulatory capital requirements.