BlackRock has a strong position in the competitive landscape

BlackRock (BLK) became the world’s largest asset management company in 2009 with the acquisition of Barclays Global Investors (BGI).

Nov. 20 2020, Updated 3:52 p.m. ET

Growing at a quicker pace

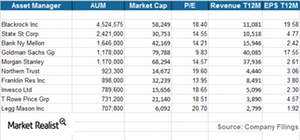

BlackRock (BLK) became the world’s largest asset management company in 2009 with the acquisition of Barclays Global Investors (BGI). The acquisition added ~$1 trillion to its existing assets under management, or AUM. BlackRock surpassed major players like State Street (STT) and Fidelity Investments.

Since then, it grew at a compound annual growth rate, or CAGR, of above 15%—including inorganic growth—in terms of AUM. Other companies like State Street, Bank of New York Mellon (BK), and Goldman Sachs (GS) grew at ~4%, 8%, and 8.6%, respectively.

Price war in European ETFs

BlackRock is also benefiting from the fast growing ETF market in the US and Europe. In Europe, it’s facing competition from various players in competitive fees. Over the last few quarters, the asset managers have been locked up in a price war over their ETF offerings in the European market. They’ve been in a bid to win over retail Deutsche Asset & Wealth Management, or Deutsche AWM, and Lyxor—an arm of Societe Generale.

State Street reduced the expense ratios by 20% for two of its popular ETFs—the SPDR Euro STOXX 50 ETF (FEZ) and the SPDR DJ STOXX 50 ETF (FEU). It also reduced the expense ratio by 15% for its core equity and fixed-income ETFs. The price reductions were initiated by Deutsche AWM. They were followed by Vanguard, Lyxor, and other mid-size players.

BlackRock reduced the expense ratios by 60% for six of its ETFs. It also announced new eight low-cost ETFs.

BlackRock is the largest player in the industry. As a result, it can leverage its position to spread the expenses across its global operations. BlackRock can decrease the impact on margins by presenting a consolidated position. It takes into account both types of end markets—higher and lower operating expenses.