Analyzing Walmart – The World’s Largest Retailer

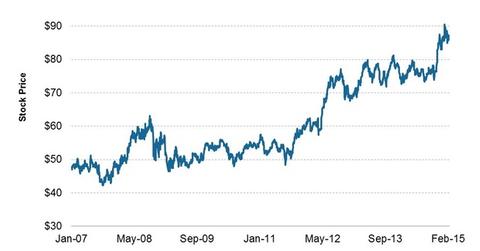

Walmart (WMT) is a mass merchandiser. It’s the world’s largest retailer. It has over 11,100 stores in ~27 countries. It has a market cap of over $275 billion.

Dec. 15 2015, Updated 7:04 p.m. ET

Retail giant

Walmart (WMT) is a mass merchandiser. It’s the world’s largest retailer. It has over 11,100 stores in ~27 countries. With a market cap of over $275 billion, it ranks among the top ten companies in the S&P 500 Index (SPY)[1. As on February 13, 2015, Ranked by market cap].

The company generated net sales of over $483 billion worldwide in the last 12 months[1. Through October 31, 2014. The company’s fiscal year ends January 31]. That’s more than four times other major companies in the retail industry—Costco (COST) at $114.5 billion, Kroger (KR) at $106.5 billion, Carrefour SA (CA.PA) (CRRFY) in France at $100 billion, Tesco (TSCO.L) (TSCDY) in the United Kingdom at $102.6 billion, and Target (TGT) at $73.7 billion.

Early history

Walmart was founded by the Waltons. Co-founder Sam M. Walton opened a franchise Ben Franklin variety store in Newport, Arkansas in 1945. His brother, James L. Walton, opened another store in Versailles, Missouri the following year. Walmart was incorporated in 1969 in Delaware. In 1962, Walmart’s first discount store, Discount City, started operations in Rogers, Arkansas. The first Sam’s Clubs were established in 1984. Walmart’s first supercenter format started operations in 1988.

Walmart’s first overseas venture began in the early 1990s in Mexico. Since then, the company expanded its operations to 25 other countries including the United Kingdom, Japan, Brazil, China, Canada, Argentina, Chile, India, and parts of Africa and Central America.

Fund exposure

Walmart’s size, financial strength, and sector orientation mean that the company is included in the portfolio holdings of several ETFs including the SPDR S&P Retail ETF (XRT) with an ~1% weight and the SPDR Consumer Staples Select Sector ETF (XLP) with an ~7.5% weight, among others. Additionally, Walmart is a significant part of various consumer staples mutual funds such as the Fidelity Select Consumer Staples portfolio.

In this series

In this series, we’ll provide an overview and analysis of Walmart, including both operational and financial aspects. We’ll also discuss the returns to investors and stock valuations. We’ll see how these compare to other companies in the retail industry.