Connection Between Equities And High Yield Bonds

Equities and high yield bonds perform well when the economy is improving, and both underperform when the economy is slumping.

Nov. 27 2019, Updated 6:36 p.m. ET

Investors also need to understand the high yield market’s “equity-like” characteristics. For instance, when high yield sells off, it tends to do so in a “risk-off” market in which other higher risk investments, like equities, are also selling off. This drop in value during a stock market decline can be an unwanted surprise for investors who expect the bond portion of their portfolio to rise in value during a risk-off market and to help shelter the overall portfolio from the impact of a market dislocation.

Market Realist – Equities and high yield bonds tend to move in a similar path

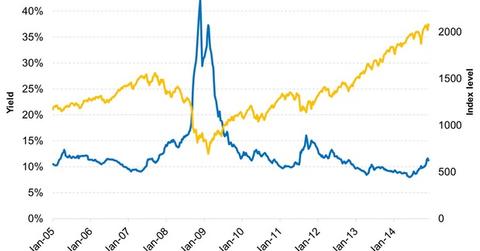

The graph above compares the BofA Merrill Lynch US High Yield CCC or Below Effective Yield to the S&P 500 Index (SPY)(IVV) over the last ten years. The graph indicates that junk bond (JNK)(HYG) yields tend to be inversely related to the S&P 500. In other words, a correlation exists between junk bond prices and the S&P 500.

This is intuitive because equities and high yield bonds perform well when the economy is improving, and both underperform when the economy is slumping. This was very noticeable during the Great Recession when junk bond yields spiked and global equities (QWLD) endured one of the worst bear markets in recent times. Investors consider both equities and high yield bonds to be “risky assets.”

The next part of this series will explain why the correlation between equities and high yield bonds is not good for your portfolio.