Price of gold relates to growth of global money supply

When money supply growth is used to prop up the financial and economic system instead of fuel strong economic growth, the price of gold relates to growth of the money supply.

Nov. 27 2019, Updated 7:36 p.m. ET

What is money supply?

Money supply is the total amount of currency and other liquid instruments in circulation in an economy. M0, M1, M2, and M3 are defined according to the type and size of the account in which the instrument is kept. M0 and M1 are called narrow money. They include coins and notes in circulation. M2 includes M1. M3 includes M2. M3 is the broadest measure of money. However, definitions vary from country to country. A country’s central bank usually collects and publishes money supply data.

Money supply and gold

The money supply can grow as a byproduct of economic growth. When money supply growth is used to prop up the financial and economic system instead of fuel strong economic growth, the price of gold relates to the growth of the money supply.

The money supply in the system increases without any corresponding increase in the supply of goods. This leads to inflationary pressures because more money chases the same amount of goods and services. It also leads to currency debasement. As we discussed previously, weakness in the US dollar and inflation lead to more demand for gold. So gold has a positive relationship to money supply.

Global money supply

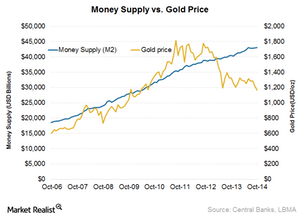

We’ve taken a proxy for global supply as the money supply of the United States, Europe (represented by the Eurozone and the United Kingdom), Japan, India, China, Russia, Brazil, and Turkey. The money supply used is M2. It’s expressed in US dollars for each country at prevailing exchange rates. In the above chart, you can see that the pace of money supply stabilized in recent months. October’s level was similar to September’s, at $43.09 trillion.

Global money supply has been increasing rapidly. The gold price increase kept pace with the global money supply until recently. The relationship between gold price and global money supply appears to have broken.

There are other factors that were probably more important. They put downward pressure on prices. An example is the expectation of the Fed’s taper. There was a huge sell-off by gold-backed ETFs such as the SPDR Gold Shares (GLD).

But the impact of money supply on gold prices gives you a partial view. It’s important to look at other factors to get a complete view of what impacts gold prices and gold stocks such as AngloGold Ashanti Ltd. (AU), Barrick Gold Corp. (ABX), Newmont Mining Corporation (NEM), Kinross Gold Corporation (KGC), and ETFs that invest in the above stocks such as the Gold Miners Index (GDX).