Outlook for General Dynamics’ individual business segments

In this part of the series, we’ll look at the outlook for General Dynamics’ individual business segments. General Dynamics has four major business segments.

Dec. 4 2020, Updated 10:53 a.m. ET

Outlook for individual business segments

In this part of the series, we’ll look at the outlook for General Dynamics’ (GD) individual business segments.

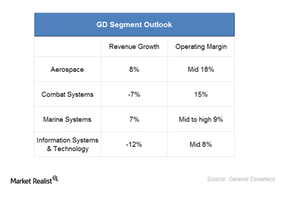

As we’ve already discussed in this series, General Dynamics has four major business segments—Aerospace, Combat Systems, Marine Systems, and Information Systems and Technology.

Aerospace outlook

General Dynamics expects an increase of ~8 % in the Aerospace segment’s revenue in 2014—compared to 2013. This is as a result of increased deliveries of Gulfstream aircraft. Operating margins are expected to be in the mid-18% range.

Combat Systems outlook

The company expects the Combat Systems segment’s full-year revenue in 2014 to be about $5.7 billion. It expects the operating margins to be around 15%. The international work offsets the majority of the scheduled declines in US military production.

Marine Systems outlook

General Dynamics expects the Marine Systems segment’s full-year 2014 revenue to increase about 7% from 2013. It expects the operating margins to be in the mid to high-9% range.

Information Systems & Technology outlook

This segment is expected to report full-year 2014 revenue at ~$9 billion. This is down 12% from 2013. This is largely due to slowed defense spending on major production programs in the mobile communication systems business. Operating margins are expected to be in the mid-8% range.

To learn more about the defense sector read Surviving the slump: Key indicators of the defense industry.

General Dynamics (GD) forms almost 2% of the holdings in the iShares Select Dividend ETF (DVY). Other companies in the aerospace and defense industry include Lockheed Martin (LMT), United Technologies (UTX), and Northrop Grumman (NOC).