Why Melco Crown Is Profitable In The Casino Space

MPEL derives ~94% of revenues from casino operations. Its casino business gross margin is 50% for the trailing 12-month period ending September 30, 2014.

Nov. 20 2019, Updated 3:58 p.m. ET

Revenue breakdown

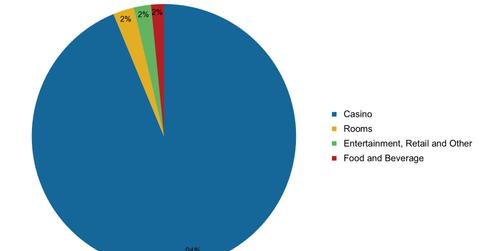

Melco Crown Entertainment (MPEL) earns its revenues through casinos, hotels, food and beverages, and entertainment and retail operations. A detailed breakdown of MPEL’s revenue follows:

Casino revenues

As we read in the previous article, MPEL has two casino-based operations, City of Dreams and Altira Macau. Casino revenues are primarily driven by growth in the mass market table games segment at these two operations. MPEL’s efficiency in the gaming floor, improved casino visitation, and casino marketing initiatives, together with strong overall mass market growth, resulted in improvement in MPEL’s mass market table games revenues.

MPEL derives ~94% of its revenues from casino operations. Its gross margin in the casino business is 50% for the trailing 12-month period ending September 30, 2014. The gross margin in the casino business for companies like Wynn Resorts (WYNN), Caesars Entertainment (CZR), and MGM Resorts (MGM) is 38%, 41%, and 38%, respectively. This shows that MPEL is comparatively more profitable in the casino business.

Investing in ETFs like the VanEck Vectors Gaming ETF (BJK) helps investors hold a diversified portfolio in these casino stocks.

Noncasino revenues

Room revenues depend on the occupancy and average daily rate (or ADR), which drive the revenue per available room (or RevPAR). For the nine months ending September 30, 2014, Altira Macau’s ADR was $230, its occupancy rate was 99%, and its RevPAR was $228. For the nine months ending June 30, 2014, City of Dreams’s ADR was $196, its occupancy rate was 99%, and its RevPAR was $193.

Other noncasino revenues primarily depend on higher business volumes associated with visitation rates, as well as the improved yield of rental income at City of Dreams.