Why investors should track crude oil inventory levels

The difference between actual and expected changes in US crude oil inventory levels affects crude prices and thus revenues and earnings of major companies.

Nov. 20 2020, Updated 5:17 p.m. ET

Crude oil inventory

The U.S. Energy Information Administration (or EIA) reports crude oil inventory levels every week on Wednesday. This report also includes inventories of refined products of crude oil such as gasoline and distillate. Inventories increase when demand is lower and decrease when demand is higher than supplies for the week.

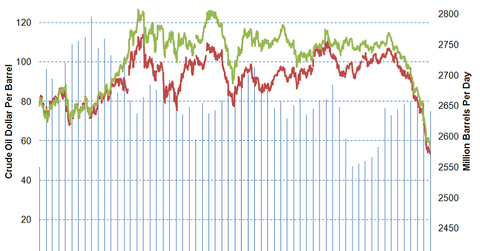

OECD crude oil inventory

OECD (Organization for Economic Cooperation and Development) generally represents developed economies. The non-OECD countries are generally developing economies. The OECD commercial inventory was 2.55 billion barrels at the end of 2013, equivalent to roughly 55 days of consumption. The EIA (Energy Information Administration) estimates OECD oil inventories will rise to 2.64 billion barrels in 2014 and 2.71 billion barrels in 2015, resulting in an increase in inventories.

What investors should track

Investors should track US and OECD crude oil inventory levels. When crude oil inventories increase more than expected, it implies either greater supply or weaker demand, which are both negative for crude oil prices. On the other hand, when crude oil inventory levels increase less than expected, it implies either weaker supply or greater demand, which is positive for crude oil prices.

The difference between actual and expected changes in US crude oil inventory levels affects crude prices and, in turn, revenues and earnings of major companies such as Continental Resources (CLR), Whiting Petroleum (WLL), Chevron Corporation (CVX), and BP (BP). These companies are all major parts of energy ETFs such as the Energy Select Sector SPDR (XLE).

Crude oil inventories are also affected by seasonal factors. Demand increases during winters in northern countries. These countries require more oil for heating, which impacts oil prices. But the seasonality factor didn’t have much impact on oil prices in 2014 due to the oversupply of oil in the market.

Investors should follow year-over-year inventories to gauge the seasonal impact in crude oil price movements. Visit our Oil and Gas Inventories page to know more.

Now let’s look at rig counts. Why is it important for investors to know bout rig counts? Read the next part of this series to find out.