Why It’s Important To Understand Global Copper Reserves

Copper mining is concentrated in Latin America, while the major copper consumers are in Asia. More than 60% of global copper consumption comes from Asia.

Jan. 30 2015, Published 2:39 p.m. ET

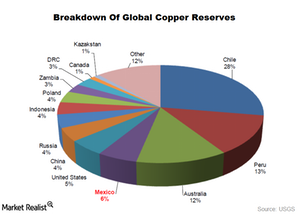

Global copper reserves

In the previous article, we discussed the various end uses of copper. Let’s explore more about global copper reserves, which will help in understanding the supply side dynamics of the copper industry. Copper reserves represent a key metric for investors in copper producers. Freeport-McMoRan (FCX) and Southern Copper (SCCO) are among the top copper producers. Freeport forms 3.63% of the SPDR S&P Metals and Mining ETF (XME).

Latin America has highest reserves

Copper reserves are highly concentrated. This is unlike other basic metals like iron ore and bauxite, which are dispersed. The above chart shows the breakout of global copper reserves, with Latin America accounting for almost half of global copper reserves. Chile has the highest reserves of copper, followed by Peru. Australia has the third biggest reserves of copper. Mining giants like Rio Tinto (RIO) and BHP Billiton (BHP) have operations in Australia.

The United States has 5% of global copper reserves. Interestingly, China only has 4% of global copper reserves, although it is the world’s largest consumer of copper.

Copper production

China has the sixth biggest copper reserves, but it is the second largest copper miner. Chile is the largest copper miner. Peru holds the third rank, while the United States ranks fourth in terms of copper mine production.

Copper mining is concentrated in Latin America, while the major copper consumers are in Asia. More than 60% of global copper consumption comes from Asia, which drives the global trade in copper. In the coming parts of this series, we will analyze the dynamics of global copper trade in detail.

After being mined, copper is then refined. In the next article, we will learn more about the value chain in the copper industry.