Why High Yield Bonds Are Attractive

In this series, we’ll discuss the many advantages of high yield bonds, their correlation with other asset classes, the rise of global high yield markets, and why high yield bonds should command a place in a portfolio.

April 10 2017, Published 12:37 p.m. ET

AB [AllianceBernstein]

Investors often think of high-yield bonds as simply another component within a fixed-income allocation. But strong risk-adjusted return potential and a low correlation to other investments may argue for giving high yield its own seat at the asset-allocation table.

Today’s fixed-income landscape features a dizzying array of securities, from US Treasury bills to corporate bonds, and from mortgage pass-through securities to catastrophe-linked bonds. On the surface, high-yield bonds seem a lot like their fixed-income relatives: they represent loans from investors to an entity, make regular coupon payments and commit to repay investors in full on a specified maturity date.

It’s not surprising, then, that investors tend to think of high yield as a component within their bond allocations. Given that high yield is one of the riskiest fixed income sectors, many investors adjust their high-yield allocations in order to raise or lower the overall risk in the fixed income component of their portfolios.

Market Realist

High yield corporate bonds offer many advantages

High yield corporate bonds (PHB) offer a higher rate of interest than investment grade bonds because of the higher probability of default. Companies issuing high yield bonds (HYG) are not rated as investment grade by rating agencies. As a result, high yield (IHY) issuers have to offer higher interest rates to attract investors and make up for the higher risk of default. If a bond carries a speculative grade rating from rating agencies, then it is considered high yield. Standard & Poor’s rates high yield bond issuers as “BB” or lower, while Moody’s Investors Service rates them “Ba” or lower.

High yield bond issuers are typically small companies burdened with high leverage or facing financial headwinds. However, in many cases, high yield bond issuers may also include large corporates facing similar issues. A large number of companies issuing bonds is listed, providing greater transparency in operations. In addition, the high yield market has substantial liquidity, making it possible to trade effectively.

Market size

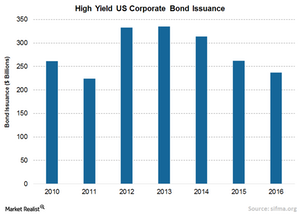

Over the last few years, the high yield market has grown rapidly, mainly aided by lower interest rates. The US high yield corporate bond (SJNK) market is valued at around $1.4 trillion, representing close to 17% of the total corporate bond market. In 2016, $237.3 billion in high yield bonds was issued, compared with $261.7 billion in 2015.

Risk factors

High yield corporate bonds (HYS) carry numerous risks, such as default, interest rate, and currency risk. It’s important to consider risk as high yield bonds are issued by companies with a higher probability of default. Though there are significant risks involved in investing in high yield bonds, investors with a higher risk appetite and seeking higher returns may find them attractive. In this series, we’ll discuss the many advantages of high yield bonds, their correlation with other asset classes, the rise of global high yield markets, and why high yield bonds should command a place in a portfolio.