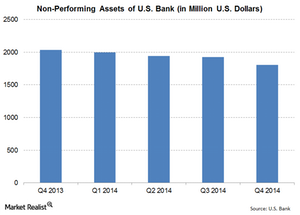

U.S. Bank’s non-performing assets declined in 4Q14

U.S. Bank’s (USB) non-performing assets were $1,808 million at the end of 4Q14. The ratio declined by 11.24%—compared to 4Q13.

Nov. 21 2019, Updated 3:46 p.m. ET

Non-performing assets impact profits and capital

Non-performing assets are loans that are in jeopardy or default by borrowers. When loans’ principal component hasn’t been serviced for more than 90 days, they’re considered non-performing assets. Banks have to provision for non-performing assets from their profits. If provisioning from profits isn’t possible, then a bank has to take a hit on its capital.

As a result, a high level of non-performing assets for a bank may impact the very existence of the bank in the long run. This conveys the importance of tracking non-performing assets.

U.S. Bank’s non-performing assets declined

U.S. Bank’s (USB) non-performing assets were $1,808 million at the end of 4Q14. The ratio declined by 11.24%—compared to 4Q13. The trend of declining non-performing assets continued throughout 2014. As a percentage of loans, non-performing assets also declined to 0.73% at the end of 4Q14.

Another indicator that shows the quality of assets is the net charge-off rate. Net charge-off represents the amount of loans that a bank believes it will never recover. U.S. Bank’s net charge-offs also fell to $308 million in 4Q14. This was slightly lower than $312 million in 4Q13. As a percentage of total loans, the net charge-off fell from 0.53% to 0.50% year-over-year, or YoY.

The fall in non-performing assets is a sector-wide phenomenon. Most of the banks in broad financial ETFs—like the Financial Select Sector SPDR (XLF)—reported a fall in this ratio during 2014 and 4Q14. These banks include JPMorgan Chase (JPM), Bank of America (BAC), and Wells Fargo (WFC).