Starbucks’ Key Operating Costs

SBUX wants to grow sales. It’s also important to manage the operating costs. In this part of the series, we’ll take a look at four key operating costs.

Dec. 31 2014, Updated 8:39 a.m. ET

Key operating costs

In the last part of this series, we learned that Starbucks (SBUX) is exploring the tea business. It wants to grow sales. However, it’s also important to manage the operating costs. In this part of the series, we’ll take a look at four key operating costs for SBUX.

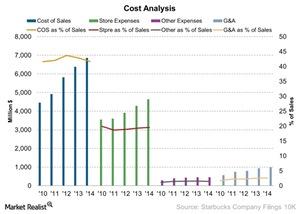

Cost of sales

In the above chart, the cost of sales also includes the occupancy costs. At the end of fiscal year 2014, SBUX’s cost of sales was $6.8 billion—compared to $6.3 billion in 2013. As a percentage of sales, this cost represented 41.7% of sales—down from 42.9% in 2013. This was mainly due to the higher operating leverage. Higher sales spread the cost of sales.

Store operating expense

In the above chart, the store operating expense was $4.6 billion for 2014—compared to $4.2 billion in 2013. This cost also declined 60 basis points—or 0.6% as a percentage of sales year-over-year, or YoY—due to operating leverage. These costs are related to the company-operated stores.

G&A expense

In 2014, G&A (general and administrative) expense was $0.99 billion—compared to $0.93 billion in 2013. The G&A expense was 6% of sales. It declined from 6.3% in 2013. It benefited from sales leverage.

Tim Hortons (THI) had a G&A expense of 4.5% of sales. McDonald’s (MCD) G&A expense was 8.2% of sales. Chipotle Mexican Grill (CMG) had a G&A expense of 6.5% as a percentage of sales.

Some of the restaurants mentioned above are also included in the SPDR S&P 500 ETF (SPY).

Other expenses that weren’t related to the company-owned stores were $48 million—compared to $46 million in 2013. It represented 4.2% of sales in 2014.

So, this brings us to SBUX’s operating income and margin performance. In the next part of this series, we’ll look at the operating margin.