Realized price: The factors impacting Vale SA iron ore

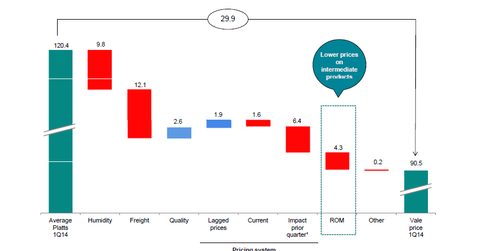

Realized prices for iron ore vary depending on quality, moisture content, freight costs, and pricing mechanisms. ROM sales reduced Vale’s realized price by about $6 per ton in 2013.

Nov. 27 2019, Updated 7:29 p.m. ET

Benchmark versus reality

There is usually a difference between the benchmark price, which is currently Platts 62% Fe CFR (cost and freight) in China, and the realized price of iron ore that a company earns. In this article, we’ll look at the factors that are responsible for this difference at Vale SA (VALE).

Quality

As mines go deeper, the iron ore, or Fe, content decreases. Depending on the quality of iron ore required, the Fe content determines what level of discount is applied to the product. With the conclusion of Vale’s S11D project, the quality of its iron ore is expected to increase.

Freight

Freight costs between Brazil and China vary based on supply and demand. Prior to 2009, costs had reached highs of $80–$90 per dry metric ton. Vale has since introduced a Valemax fleet to reduce its freight costs to as low as $22 per ton. We’ll discuss Valemax ships and their cost implications in detail, later in this series.

Pricing system

Vale pricing systems include the following:

- Lagged – Under this system, sales are based on past prices. Prices are calculated based on the average price of the past three months ending one month before the current quarter.

- Provisional – Under this agreement, customers are invoiced based on provisional prices and the final prices are settled in the subsequent quarter, upon delivery.

- Current – Sales are completed and prices, settled in the current quarter based on monthly averages or daily prices.

ROM sales

ROM, or run of mine, ore is the raw mined material as it is delivered before undergoing any sort of treatment. Sale of this intermediate product brings average realized prices down. ROM sales reduced Vale’s realized price by about $6 per ton in 2013.

Realized prices also vary for Vale’s rivals, which include BHP Billiton Ltd. (BHP), Rio Tinto plc (RIO), Cliffs Natural Resources Inc. (CLF), and Fortescue Metals Group Ltd. (FSUGY), based on quality, moisture content, freight costs, and pricing mechanisms.

The SPDR S&P Metals and Mining ETF (XME) invests in the above-mentioned stocks.