What rating action did Moody’s announce for Japan?

On December 1, 2014, Moody’s Investors Service, a business unit of Moody’s Corporation (MCO), downgraded Japan’s debt rating by one notch, from Aa3 to A1, with a stable outlook.

Dec. 16 2014, Updated 4:38 p.m. ET

Rating downgrade

On December 1, 2014, Moody’s Investors Service, a business unit of Moody’s Corporation (MCO), downgraded Japan’s debt rating by one notch, from Aa3 to A1, with a stable outlook.

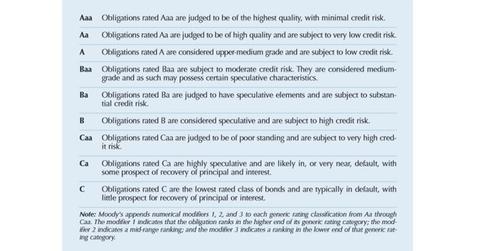

The above chart details the rating scales used by Moody’s for long-term obligations. As mentioned in the note at the bottom of the chart, modifiers 1, 2, and 3 are used from scale Aa to Caa. Japan’s rating was at the lowest end of the Aa scale and now is at the highest end of the A scale, thus resulting in a one-notch downgrade.

Rating outlook

Apart from rating scales, Moody’s also assigns a rating outlook, which is “an opinion regarding the likely direction of an issuer’s rating over the medium term.” An outlook may belong to one of the following four categories:

- Positive

- Negative

- Stable

- Developing (dependent upon an event)

A stable outlook means that for Japan, upside risks like resumption of economic growth and downside risks like loss in economic momentum are in balance.

Rationale

The latest rating action has pushed Japan down one level below countries such as China and South Korea. The gap with top-rated countries such as the United States and Germany has widened further. For investors of Japanese-focused exchange-traded funds (or ETFs) such as iShares MSCI Japan Index Fund (EWJ) and WisdomTree Japan Hedged Equity Fund (DXJ), it’s important to know why Moody’s took this rating action.

The same goes for investors in iShares MSCI EAFE Index Fund (EFA), Vanguard MSCI EAFE ETF (VEA), and Vanguard FTSE Pacific ETF (VPL), which have more than 20% exposure to Japanese stocks.

Moody’s stated that the following three drivers led it to downgrade Japan:

- Heightened uncertainty over the achievability of fiscal deficit reduction goals

- Uncertainty over the timing and effectiveness of growth-enhancing policy measures against a background of deflationary pressures

- Increased risk of rising Japanese government bond (or JGB) yields and reduced debt affordability over the medium term

In the next article in this series, we’ll look at these drivers in detail.