An overview of ExxonMobil

Exxon Mobil’s (XOM) stock price went up 2.4%, to $96.71, on October 31, 2014. Starting in November 2013, Exxon Mobil’s share price went up by 1.5%.

Nov. 20 2014, Published 1:20 p.m. ET

ExxonMobil’s 3Q14 earnings

ExxonMobil Corporation (XOM) released its 3Q14 earnings on October 31, 2014. We’ll discuss the company’s earnings in this series. But before we analyze ExxonMobil’s 3Q14 performance, we’ll look at the company’s operations.

ExxonMobil: Operations and geography

ExxonMobil Corporation (XOM) engages in exploration and production of oil and natural gas, petroleum refinement, petrochemical manufacturing, and transportation and sale of crude oil, natural gas, and petroleum products.

ExxonMobil has several divisions and a number of affiliates. Broadly, its operations are divided into three segments: Upstream, Downstream, and Petrochemicals.

Geographically, ExxonMobil’s operations are organized in the following four primary locations:

- United States

- Canada/South America

- Europe, Africa, Asia

- Australia/Oceania

Stock price goes up in 2014

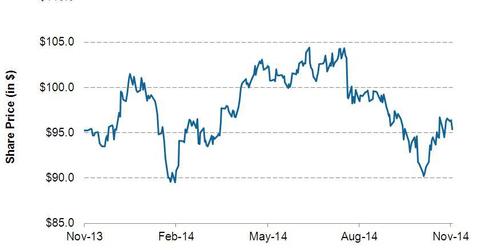

ExxonMobil’s (XOM) stock price went up 2.4%, to $96.71, on October 31, 2014, the day the company released its earnings. Its share price has fluctuated within a range of $89.80 and $104.38. Starting in November 2013, ExxonMobil’s share price went up by 1.5%.

Other companies in this industry that have recently reported 3Q14 earnings are Hess Corporation (HES) and Chevron Corporation (CVX). Hess stock price went up by ~1% following the release of its latest results, while Chevron’s stock price increased by ~2% subsequent to its earnings release.

ExxonMobil (XOM) is a component of the Standard and Poor’s depositary receipt (or SPDR) Energy Select Sector (XLE) and SPDR S&P 500 exchange-traded fund (or ETF) (SPY). Hess and Chevron are components of the SPDR Energy Select Sector (XLE).