Market Share Gain Spurs NIKE’s North American Footwear Revenues

In the US, in 2014 year-to-date, NIKE, Converse, and the Jordan brands combined accounted for over 60% of market share in athletic footwear.

Nov. 20 2020, Updated 11:10 a.m. ET

NIKE’s product portfolio

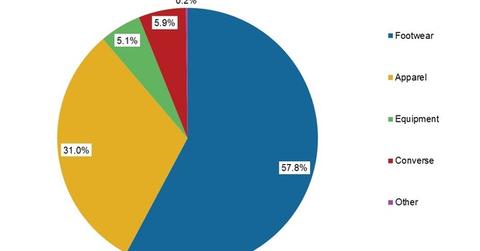

NIKE (NKE) reports product revenues according to five major categories:

- Footwear

- Apparel

- Equipment

- Converse

- Global brand revenues

Footwear market leadership

NIKE is the world’s market leader in athletic footwear with a 33.6% market share.[1. Merrill Lynch, ADP Group estimates] NIKE’s history of innovation began with the manufacture of footwear in the 1960s. Today, this remains the company’s largest product category. Footwear sales worldwide came in at $4.3 billion, or 57.8% of total revenues, in 2Q15.[2. Fiscal year ending May 31, 2015]

North American market

North America is NIKE’s largest footwear market. More than that, it’s where popular brands and footwear models become the trendsetters that later find their way to other NIKE markets. The North American market accounted for 45% of footwear revenues, or $1.9 billion in 2Q15.

Market share gains

The size of the overall US athletic footwear market is estimated to be $21.2 billion in 2014.[3. National Sporting Goods Association]

In the US, in 2014 year-to-date, NIKE, Converse, and the Jordan brands combined accounted for over 60% of market share in athletic footwear. That’s up from 35% in 2005 and 57% in 2013. Most gains came at the expense of global rival Adidas (ADDYY), which lost 2% share. Under Armour’s (UA) market share of footwear products, meanwhile, rose by 1% to 3% in that time frame. Skechers USA (SKX), too, expanded its share of the footwear market, from 3% to 4% over the period.[3. Up to September 27, 2014. SportsOneSource]

NIKE is part of the SPDR Dow Jones Industrial Average ETF (DIA).