Can Under Armour’s Growth Model Cope With These Threats?

Key threats to the company include higher labor costs and greater regulation. After the Bangladesh factory tragedy, stricter regulations can be expected.

Nov. 20 2020, Updated 5:09 p.m. ET

Competition for retail space

Under Armour, Inc. (UA) competes with other sportswear and footwear manufacturers for floor space at retailers such as Footlocker, Inc. (FL) and Finish Line Inc. (FINL). If such retailers earn higher margins from displaying competitor products, this might affect UA’s revenues and earnings.

Innovation and product development

The ability to innovate is key to building brand awareness and staying ahead of the pack. If United Armour, or UA, stops developing and marketing new products, its ability to grow in a highly competitive market will be severely limited.

Higher labor costs in Asia

Other key threats to the company are higher labor costs and greater regulation. According to an International Labor Organization report released in early December, wage gains in Asia were higher than in the rest of the world last year. In fact, wages rose by an average of 6% in Asia and by 9% in China (MCHI)(FXI)(ASHR) in 2013. Meanwhile, annual wage increases averaged 2% globally. Since most of Under Armour’s suppliers and manufacturers are based in Asia, cost-side pressures will likely result.

More government regulation for overseas factories could also be in the cards. Higher factory standards would result in higher manufacturing costs, which would ultimately hit UA’s bottom line.

The apparel industry has faced a growing backlash from human rights groups in the wake of the Bangladesh factory collapse last year. The catastrophe, thought to be the worst apparel factory accident in history, resulted in the deaths of 700 garment workers.

Higher labor costs and greater regulations may also impact other apparel and footwear companies with overseas operations, such as The Gap, Inc. (GPS), among others.

Currency headwinds

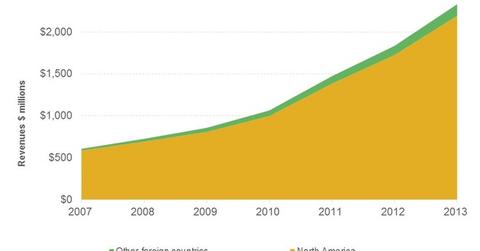

As yet, UA doesn’t have significant operations overseas. But as more and more revenues are derived from international operations, returns to shareholders may be affected by adverse currency movements versus the US dollar.

To read more sector updates, visit Market Realist’s Consumer and Retail page.