Will Peabody Energy’s Impressive 3Q15 Cost Performance Help?

Peabody Energy (BTU) reported Midwest production costs of $32.51 a ton in 3Q15, compared to $34.56 a ton in 3Q14.

Oct. 29 2015, Published 3:37 p.m. ET

Midwest operations

Peabody Energy (BTU) reported Midwest production costs of $32.51 a ton in 3Q15, compared to $34.56 a ton in 3Q14. The costs in the Midwest fell in spite of lower tonnage, primarily due to the positive impact from the fall in diesel costs and cost reduction initiatives.

Other American coal producers (KOL) like Arch Coal (ACI) and Cloud Peak Energy (CLD) also benefited from the fall in oil prices. However, the extent of the benefit depends on the hedging strategies of the companies. All major coal companies are part of the iShares Russell 3000 ETF (IWV).

Western operations

The cost per ton for Peabody Energy’s Western operations for 3Q14 rose to $27.98 a ton in 3Q15. Lower shipments and expenditure on the movement of machinery affected the cost per ton for Western coal.

Powder River Basin

Powder River Basin costs dropped marginally to $10.03 a ton in 3Q15.

Overall US operations

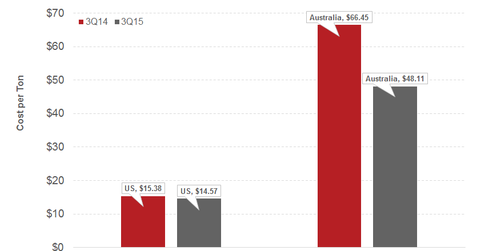

The cost per ton for Peabody Energy’s overall US operations came in at $14.57 in 3Q15 compared to $15.38 a ton in 3Q15 on account of lower costs in the Midwest and the Powder River Basin.

Australian operations

Australian operations drove the overall cost saving in 3Q15 on account of cost-saving measures and lower fuel costs. The cost per ton for Australian operations came in at $48.11 in 3Q13, down from $66.54 in 3Q14. Cost per ton for both thermal and metallurgical coal from the region fell during the quarter.