How does Occidental Petroleum compare to industry peers?

In terms of profitability, OXY has the highest profit margins amongst its peers at 24.2%. OXY also has one of the highest dividend yields at 2.85%.

May 3 2021, Updated 11:00 a.m. ET

Industry peers according to size

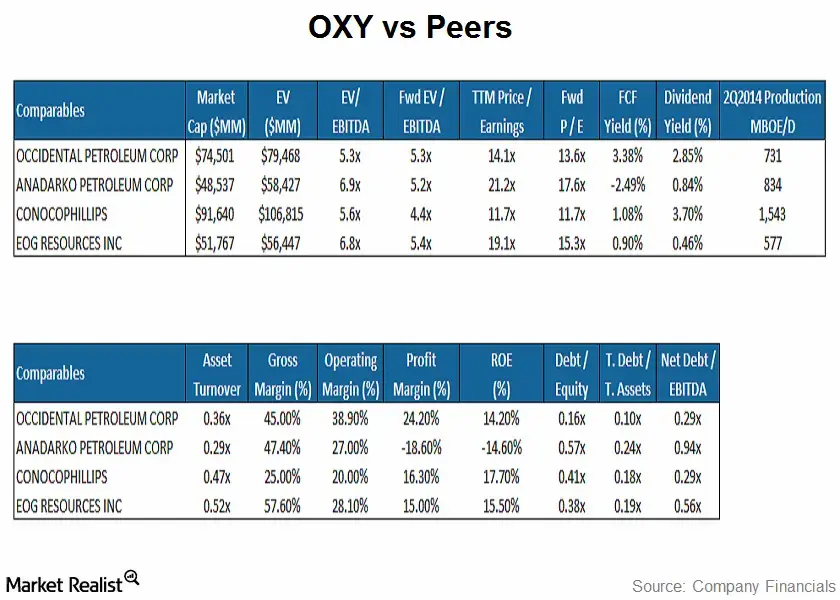

As noted by the table below, ConocoPhillips (COP) is the largest company by market capitalization and enterprise value (or EV) among oil and gas companies. Companies in this industry include Occidental Petroleum (OXY), Anadarko Petroleum (APC), and EOG Resources (EOG). These companies are all components of the Energy Select Sector SPDR ETF (XLE).

Production

Amongst its peers, COP had the highest production for the six months ended June 30, 2014, at 1,543 thousand barrels of oil equivalent per day, followed by APC at 834,000. EOG had the lowest production amongst its peers at 577,3000 thousand barrels of oil equivalent per day.

EV/EBITDA

EV to earnings before interest, taxes, depreciation, and amortization (or EBITDA), is the lowest for OXY, closely followed by COP. This indicates relative cheapness of both the companies compared to peers.

Net debt/EBITDA

Again, when scaled in terms of EBITDA, debt levels are lowest for OXY and COP, implying better capital handling.

Strong forward price/earnings estimates

While the price/earnings (or P/E) ratio for COP is the lowest, forward P/E ratio remains unchanged. This means that analysts expect COP’s earnings to remain unchanged. However, OXY’s P/E is one of the lowest in the group, implying analyst’s expectations of increase in OXY’s earnings.

Returns and dividend

In terms of profitability, OXY has the highest profit margins amongst its peers at 24.2%. OXY also has one of the highest dividend yields at 2.85%, and the best free cash flow (or FCF) yield among its peers here.

Valuation

So, given OXY’s relative cheapness, low debt, decent dividend and FCF yields, and expectations of earnings growth, the company could be a good value investment for the long term.

However, it must be noted that as crude prices fall, energy stocks also fall. To find out more, check out our weekly series on crude inventories and prices.