Key differences between PCE and CPI as inflation measures

The CPI and PCE are both important indicators of U.S. inflation. CPI is more important from an individual perspective, while PCE is more important for monetary policy.

Nov. 20 2020, Updated 11:54 a.m. ET

Two measures of inflation

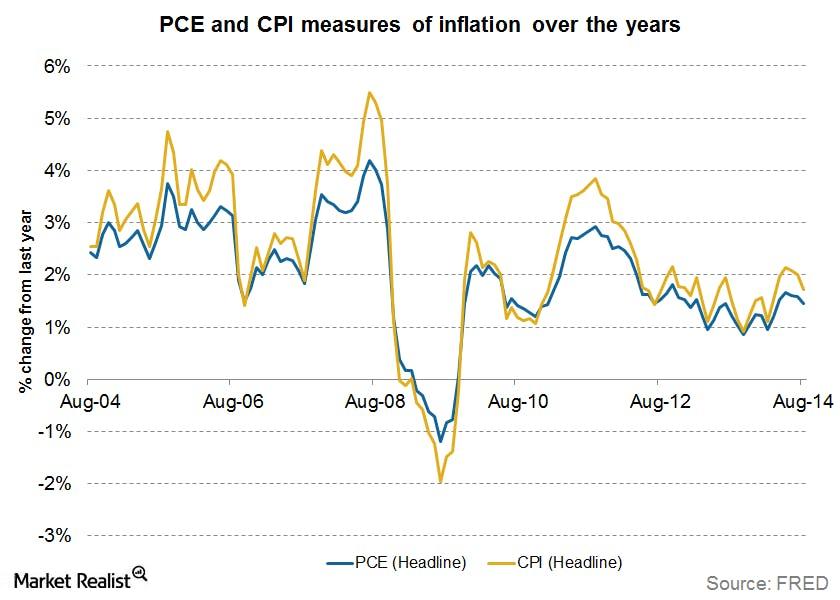

The PCE (personal consumption expenditure) price index and the CPI (consumer price index) are closely correlated and follow similar trends. However, the measures are not identical. As per research from the Cleveland Fed, prices have increased by 39% as per CPI and 31% as per PCE since 2000.

The graph above shows how the CPI has historically been higher than PCE estimates. The differing PCE and CPI estimates are primarily due to differences in computation. There are four reasons for the differences in the two measures.

The formula effect

The Bureau of Labor Statistics calculates the CPI by using the modified Laspeyres formula, while the Bureau of Economic Analysis uses the Fisher Price formula to calculate the PCE.

The weight effect

The relative importance, or weights, accorded to components of the respective indices vary. The weight accorded to housing (IYR), for instance, is as high as 42% in CPI, while it is only 15% in PCE. This difference in weights often causes a divergence in estimates.

Also, the frequency of rebalancing of weights is different for CPI and PCE. PCE assumes that consumer spending habits change quarterly, and thus, rebalancing occurs quarterly. CPI assumes that consumer expenditure habits change every two years and rebalancing occurs every 24 months.

The scope effect

The CPI and PCE do not cover identical categories of personal spending. The PCE has a broader scope than the CPI, as it captures the expenditures by both rural and urban consumers. Unlike the CPI, the PCE includes expenditures from non-profit institutions that serve households.

CPI only records out-of-pocket expenditure on medical and health care (XLV). The PCE on the other hand, also includes expenses paid by employers and other federal programs.

Other effects

Other effects include differences in the way seasonal adjustments are made, how items like airline fares are treated, and other residual differences.

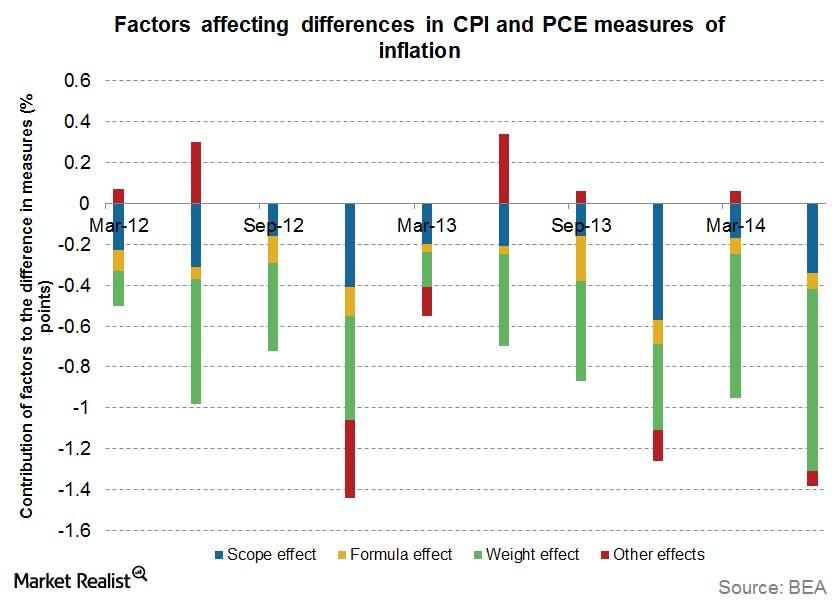

The weight effect leads to the maximum divergence between CPI and PCE, as the graph above illustrates.

The Fed too has given preference to PCE due to its broader scope and “chained base” for calculations. The Fed serves a dual mandate, price stability, and strength in employment. The Fed has said it would raise rates only when the economy achieves 2% core PCE inflation. The rate hike would affect both the U.S. equity (SPY), bonds (BND), and Treasury (TLT) markets.

The CPI and PCE are both important indicators of U.S. inflation. While CPI is more important from the perspective of an individual, PCE is more important from the perspective of monetary policy. The broader scope of PCE makes it better suited to indicate long-term inflationary trends according to the Fed.

Read our series on Essential indicators tracked by investors and the Fed to understand the other indicators that affect you as an investor.