Overview of Caesars Entertainment and its complicated past

Caesars Entertainment has 51 casinos in 13 U.S. states and five countries. 38 are in the U.S. and primarily consist of land-based and riverboat casinos.

Nov. 20 2020, Updated 11:20 a.m. ET

Background of Caesars Entertainment

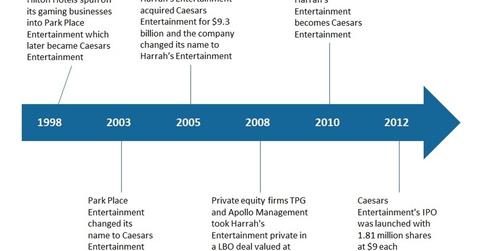

Caesars Entertainment (CZR) started in 1998 when Hilton Hotels spun off their gaming business, calling it Park Place Entertainment. In 2003, the business’s name changed to Caesars Entertainment. Then in 2005, Harrah’s Entertainment acquired CZR in a deal valued at $9.3 billion. Soon after the deal, the company was renamed again as Harrah’s Entertainment.

In 2008, private equity firms Texas Pacific Group and Apollo Management took Harrah’s Entertainment private in a $30.7 billion leveraged buyout. The company once again changed its name to Caesars Entertainment in 2010. In 2012, CZR launched in an initial public offering valued at $16.3 million.

Overview

Nevada-based CZR owns, operates, and develops casinos throughout the world. The company conducts business through its wholly owned subsidiaries, Caesars Entertainment Operating Company (or CEOC) and Caesars Entertainment Resort Properties (or CERP) and their subsidiaries. CZR also consolidates Caesars Growth Partners (or CGP), which is a variable interest entity (or VIE), as it is the primary beneficiary to CZR.

CZR has 51 casinos in 13 U.S. states and five countries. Out of the 51 casinos, 38 are in the U.S. and primarily consist of land-based and riverboat or dockside casinos, while 13 are international land-based casinos, most of which are in England.

Moreover, CZR has ~42,000 hotel rooms, and its resorts primarily operate under the Harrah’s, Caesars, and Horseshoe brand names.

The next parts of this series will discuss why CZR has been struggling to recover from the recession and hasn’t posted a profit since 2010. In contrast, industry peers like Wynn Resorts (WYNN), Melco Crown Entertainment (MPEL), and Las Vegas Sands (LVS) have posted huge profits in recent years.

ETFs like the Consumer Discretionary Select Sector SPDR Fund (XLY) provide overall exposure to these companies.