Could the Bank of Japan Drive the Yen Lower this Week?

The Japanese yen (JYN) registered its second consecutive weekly gain against the US dollar.

Jan. 23 2018, Updated 7:35 a.m. ET

Japanese yen finally gains against the US dollar

The Japanese yen (JYN) registered its second consecutive weekly gain against the US dollar. For the week ended January 19, the yen (FXY) closed at 110.78 against the US dollar (UUP), rising 0.23% from its previous week’s close of 111.04.

The key reason for the yen’s gain was the weakness of the US dollar, as there were no major economic reports originating from Japan in the previous week.

Japanese equity markets (EWJ) remained upbeat for the week. The Nikkei 225 (JPXN) posted gains of 0.65%, and the TOPIX index rose 0.72% for the week ended January 19.

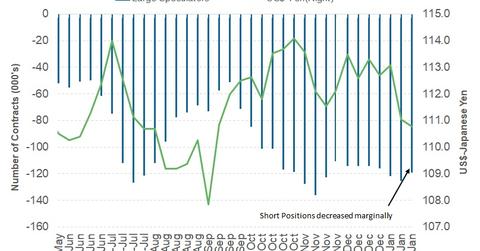

Speculators’ positions remain unchanged

Speculators in the Japanese yen (YCL) remained bearish on the Japanese yen on January 16. According to the January 19 Commitment of Traders report, the net speculative positions totaled -119,350 compared to -125,536 in the previous week. Changes to speculator positioning can be expected after the Bank of Japan’s (or BOJ) statement on Tuesday, January 23, 2018.

Outlook for the Japanese yen

The BOJ meeting is the key event for the Japanese economy this week, although it had been considered as a non-event until recently. However, the reduction of bond purchases on January 9 and the optimistic comments from BOJ governor Haruhiko Kuroda have increased the importance of this week’s event.

The BOJ is likely to hone its message and remain dovish to limit further gains in the yen. The Japanese economy has a long way to go before it reaches its inflation target, and we believe that the BOJ could retain its ultra-loose policy at this week’s meeting.