Why the price-to-book value ratio affects returns on equity

Historical analysis has shown that return on equity has a strong impact on banks’ value creation in the long run. So financials that have high price-book value ratios should also have high returns on equity.

Aug. 28 2014, Updated 5:48 p.m. ET

Overview

Now that we understand price-book value ratio better, let’s have a thorough look at how you can use this ratio. We noted earlier that book value is a reliable measure of valuation, considering the fluid nature of a bank’s assets and liabilities. All banks use mark-to-market accounting, unlike non-financials in which there may be a wide disparity between book value and actual market value.

Using the dividend discount model, it’s possible to show that a stable firm’s price-book value ratio is determined by the difference between the return on equity and the required rate of return on its projects. But we won’t go into the complex mathematics of this. We would also like to state here that return on equity is one of the central measures of performance in the banking industry. This is true for traditional banks like Wells Fargo (WFC), investment banks like Goldman Sachs (GS) and Morgan Stanley (MS), full service banks like JP Morgan (JPM) or any other financial companies included in an ETF like Financial Sel Sect SPDR FD (XLF).

Return on equity

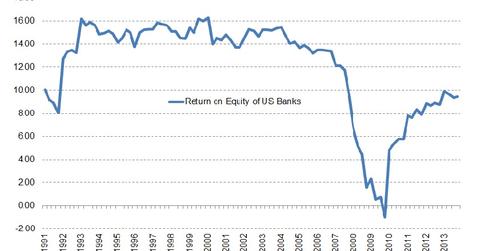

Historical analysis has shown that return on equity has a strong impact on banks’ value creation in the long run. So financials that have high price-book value ratios should also have high returns on equity. Firms that have low price-book value ratios should have low returns on equity. This is what investors must keep an eye on for, any mismatches. Mismatches would normally signal either a buying or selling opportunity. However, you must also keep a close eye on the stressed assets or risk measures of a bank. Most of the time, CEO compensation is linked to return on equity, which leads to management taking higher risks.

The return on equity (or RoE) graph above details historical returns on equity of banks in the U.S. from 1991. It clearly shows a sharp dip in returns on equity during the financial crisis and how the crisis impacted the price-book value multiples and the prices of stocks. Post-2010, there’s been a recovery. In fact, returns on equity went above 10% for the first time since the crisis.