Must-know: Why crude oil inventories can affect prices

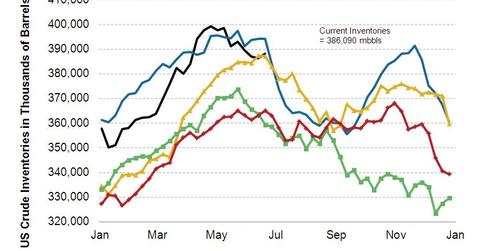

Every week, the U.S. Energy Information Administration (or EIA) reports figures on crude inventories, or the amount of crude oil stored in facilities across the United States.

Nov. 22 2019, Updated 7:18 a.m. ET

Oil and refined product inventory data can move crude oil prices

Every week, the U.S. Energy Information Administration (or EIA) reports figures on crude inventories, or the amount of crude oil stored in facilities across the United States. The EIA also provides data on inventories of distillate and gasoline, which are refined products of crude oil.

The markets monitor these figures because inventory data can indicate supply and demand trends. If the increase in crude inventories is more than expected, it implies either greater supply or weaker demand and is bearish for crude oil prices. If the increase in crude inventories is less than expected, it implies either weaker supply or greater demand and is bullish for crude oil prices. Crude oil prices highly affect earnings for major oil producers such as Chevron (CVX), ExxonMobil (XOM), and Hess Corporation (HES)—all of which are major components of energy ETFs, such as the Energy Select Sector SPDR (XLE) and the Vanguard Energy ETF (VDE).

Another important figure the EIA reports is the level of crude oil inventories at Cushing, Oklahoma. Cushing is a major inland oil hub in the U.S. Inventories from Cushing show how effectively increased U.S. oil production is moving from major inland production areas such as the Bakken in North Dakota and the Permian in west Texas to end refining markets. A build-up of inventories at Cushing may indicate that oil supplies are growing faster than takeaway infrastructure to end refining markets can keep up. Many of these end markets are on the Gulf Coast.

Last week, crude oil prices increased after the EIA’s inventory report. Continue to the next part of this series for details.