Must-know : A brief overview of natural gas storage contracts

High volatilities in prices increase the extrinsic value of storage assets because it creates more opportunities for profitable storage optimization.

Nov. 22 2019, Updated 7:19 a.m. ET

Natural gas storage contracts

Owners and operators of storage facilities don’t have to be the owners of the gas they hold in storage. Most of the gas is held under lease with shippers, LDCs, or end users who own the gas. Therefore, the type of entity that owns or operates the facility determines to some extent, how they structure their contracts. Below are the most common contacts used by storage service providers.

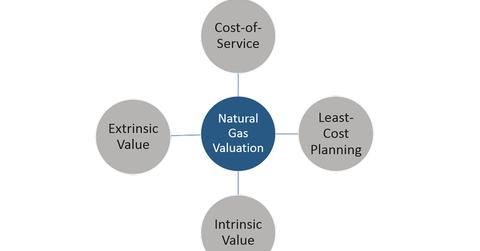

Cost-of-service – This type of valuation is used primarily by interstate pipeline companies who are regulated by the Federal Energy Regulation Commission (or FERC). The FERC requires that the rates and tariffs are published publicly. This method allows for pipeline companies to recover their cost of developing as well as an agreed upon return on investment.

Least-cost planning – This valuation mode is typically used by LDCs. It depends on the consumer and their respective load.

Intrinsic value – This is the price differential the storage asset owner can realize given the current spot price. The forward price is the intrinsic value. Intrinsic value is impacted by injection and withdrawal level relative to storage inventory. Therefore, seasonal spreads predominantly impact the intrinsic value of storage as large spread between summer and winter prices provide greater value for storage service.

Extrinsic value – The extrinsic value is the potential value the storage providers are expected to realize due to future movement of the spot and future prices. This type of valuation is also effected by injection and withdrawal levels. High volatilities in prices increase the extrinsic value of storage assets because it creates more opportunities for profitable storage optimization.

Independent storage service providers

With the deregulation of underground storage combined with other factors such as the growth in the number of gas-fired electricity generating plants, many salt formation and other high deliverability sites, both existing and under development, have been initiated by independent storage service providers, often smaller and focused companies. They’re utilized almost exclusively to serve third-party customers who can benefit the most from the characteristics of these facilities, such as marketers and electricity generators.

Currently, there are three major publicly traded independent storage firms, PAA Natural Gas Storage (PAA), Niska Gas Storage Partners (NKA), and Crestwood Equity Partners L.P. (CEQP). PAA is part of the Alerian MLP ETF (AMLP), while CEQP is part of the Global X MLP ETF (MLPA).