Introducing Simon Property Group: A Must-Know Company Overview

Headquartered in Indianapolis, Simon Property Group formed in 1993 when the shopping center division of Melvin Simon & Associates became publicly-traded.

Sept. 16 2015, Published 2:57 p.m. ET

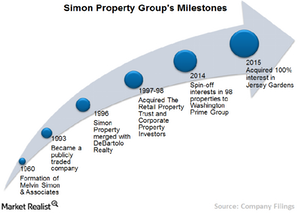

A quick look into Simon’s history

Headquartered in Indianapolis, Indiana, Simon Property Group (SPG) formed in 1993 when the shopping center division of Melvin Simon & Associates became a publicly-traded company. Melvin Simon & Associates had formed earlier, in 1960, by Fred Simon, Herbert Simon, and Melvin Simon. Simon Property is the only REIT (real estate investment trust) in the S&P 100 Index and employs about 5,500 worldwide.

Business interest

The company operates as a self-administered and self-managed REIT. It owns, develops, and manages retail real estate properties that primarily consist of:

- regional malls

- premium outlets

- The Mills outlets

Simon Property Group, L.P., or the Operating Partnership, is the majority-owned partnership subsidiary of Simon Property Group that owns the real estate assets of the company.

Competitors

Simon Property is the largest retail REIT company in the US with a market capitalization of $55.5 billion. The company competes with numerous other malls, outlet centers, community and lifestyle centers, and shopping centers in the US and abroad. The company also competes with internet retailing sites that provide retailers with distribution options beyond existing brick-and-mortar retail properties.

Major competitors of Simon Property in the regional malls REIT space include:

- Chicago-based General Growth Properties (GGP)

- California-based Macerich (MAC)

- Tennessee-based CBL & Associates Properties (CBL)

- Michigan-based Taubman Centers (TCO)

Investors looking for exposure in commercial real estate can invest in REIT ETFs. Simon Property and Public Storage (PSA) make up 8.16% and 4.06% of the Vanguard REIT ETF (VNQ), respectively. Equity Residential (EQR) comprises 6.7% holdings of the iShares Cohen & Steers REIT ETF (ICF).

In this 16-part series, we’ll take an in-depth look at Simon Property Group’s business, numbers, and investment prospects.

Series parts

- Introducing Simon Property Group: A Must-Know Company Overview

- Simon Property Group’s Key Business Segments

- Simon Property Group’s Retail Mall Business

- Simon Property Group’s Top Real Estate Tenants

- Simon Property Group’s Acquisition Growth Strategy

- Simon Property Group’s Plan to Increase Shareholder Returns

- Simon Property Group’s Key Operating Metrics

- Simon Property Group’s Lease Length Exposure

- Simon Property Group Has Reported Decent Revenue Growth in Recent Years

- Simon Property’s Cost Structure Breakdown in 2014

- Simon Property Group’s Expansion and Redevelopment Projects

- Simon Property Group Recorded Highest Ever Funds from Operations in 2014

- Simon Property Group Offers Steady and Consistent Dividends to Shareholders

- Simon Property Group’s Debt-to-Equity Ratio One of the Highest in Its Peer Group

- Simon Property Group Trades at Higher Price-to-FFO Multiple Among Peers

- How to Invest in Simon Property Group through ETFs