Russian Consumer Confidence Is on the Rise

Several macroeconomic indicators are suggesting that the Russian (RSX) economy is improving.

Nov. 20 2020, Updated 1:05 p.m. ET

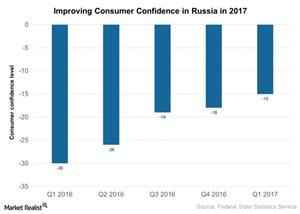

Consumer confidence in Russia

Several macroeconomic indicators are suggesting that the Russian (RSX) economy is improving. Consumer and business confidence is one such indicator, standing at the highest level in the last five years.

Consumer confidence

Consumer confidence in Russia (RUSL) rose to -15 in 1Q17 from -18 in 4Q16. It was the highest reading since 3Q14. Households showed less pessimism about Russia’s economic situation over the next 12 months. The consumer sentiment in regards to personal financial situations and conditions for major purchases showed improvement in 1Q17.

Impact of improved consumer confidence

Consumer confidence is a key indicator of an economy’s overall health. Consumer confidence usually increases when the economy expands and vice versa. Russian equities posted a stellar performance in 2016 and ended up surprising most market participants. The Russian ruble also rose sharply, enhancing the profitability of local-currency investments in 2016. It also supported the inflow of money from non-residents, further increasing the attractiveness of Russian equities and bonds. Foreign direct investment in Russian equities stood at $3 billion in the first three quarters of 2016 as compared to an outflow of about $0.3 billion in the same period last year.

The iShares MSCI Russia Capped ETF (ERUS), which offers exposure to Russian equities, rose about 55% in 2016. It’s heavily concentrated with over 60% of allocation to its top ten holdings and around 50% to the energy sector. Some of the top holdings include Gazprom (OGZPY), PJSC Lukoil (LUKOY), Sberbank Russia OJSC (SBRCY), and OAO Tatneft (OAOFY).

Let’s look at Russian equity performance in detail in the next article.