Knowing the Treasury discount rate and yields before investing

Investors can take an informed decision by knowing the rate of return on their investment.

Nov. 22 2019, Updated 6:08 a.m. ET

Discount rate

Mostly, the short-term and money market instruments like commercial paper and Treasury bills (BIL) are quoted at a discount rate. In other words, discount is the required rate of return investors expect on short-term securities. We have already discussed in the Part 4 of the series that every week the U.S. Treasury department issues four-week (BIL), 13-week, and 26-week short-term (SHY) bills, which offer a discount on the face value.

Since T-bills do not pay interest periodically, the return or premium earned in these securities is generally a difference between the face value of the bill and the purchase price paid at the auction. T-bill discount rate can be calculated by [face value – bill price] × (360/number of days until maturity). For example, a 13-week bill with a face value of $1000 and a purchase price of $970, offers implied discount rate of ([$1000-$970] × (360/90 days))/$970 = 12.4%.

Price and yields on T-notes and bonds

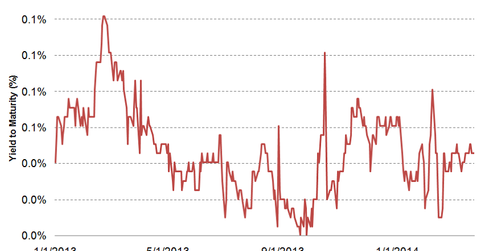

Both T-notes and T-bonds offer yields. Essentially, a yield is a rate of return an investor will receive by holding a bond until maturity. So for an investor to know what their investment in bonds will earn, they should know the yield offered by the security that they are buying.

The bonds and notes can be issued at par, premium, or a discount. If the bond (TLT) offers coupon rate equal to prevailing yield, then the bond is issued at par. However, when the bond (TBT) offers lower coupon rate than the prevailing yield, the bond is issued at a discount (less than par value). If the coupon rate is higher than expected yield, then the bond (TLH) will be issued at premium (greater than par value).

The yield-to-maturity is a discount rate which equates to the present value of future cash flows to current market price. For example, the price of a bond is $800 with a face value of $1000 bond—a case of issued at discount (less than par value)—issued at 10% coupon rate for ten years would have a yield to maturity of 14.2%.