Sandra Nathanson

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sandra Nathanson

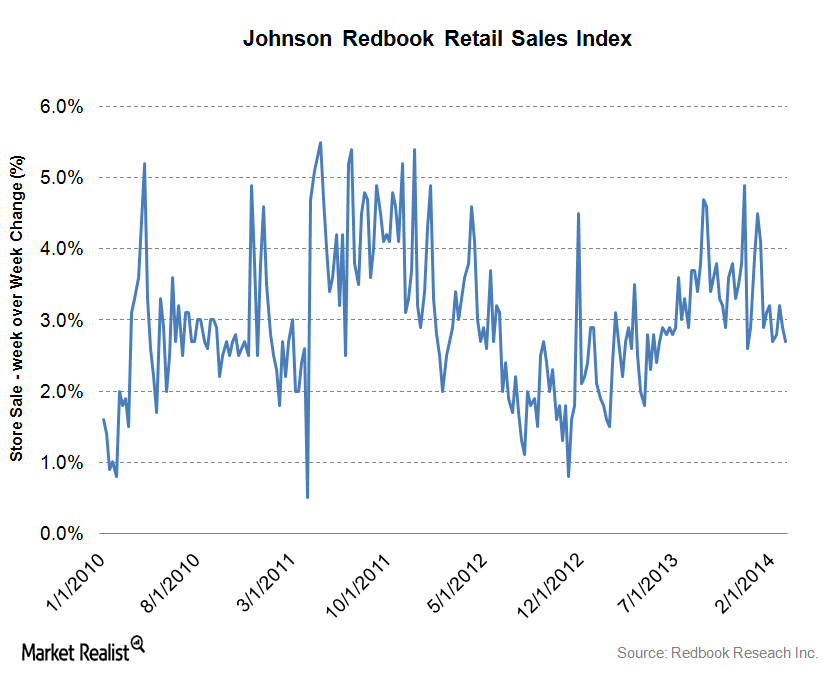

Must-know update: Redbook Index same-store sales data released

The Redbook Index released the same-store weekly data on Tuesday, March 11, 2014.

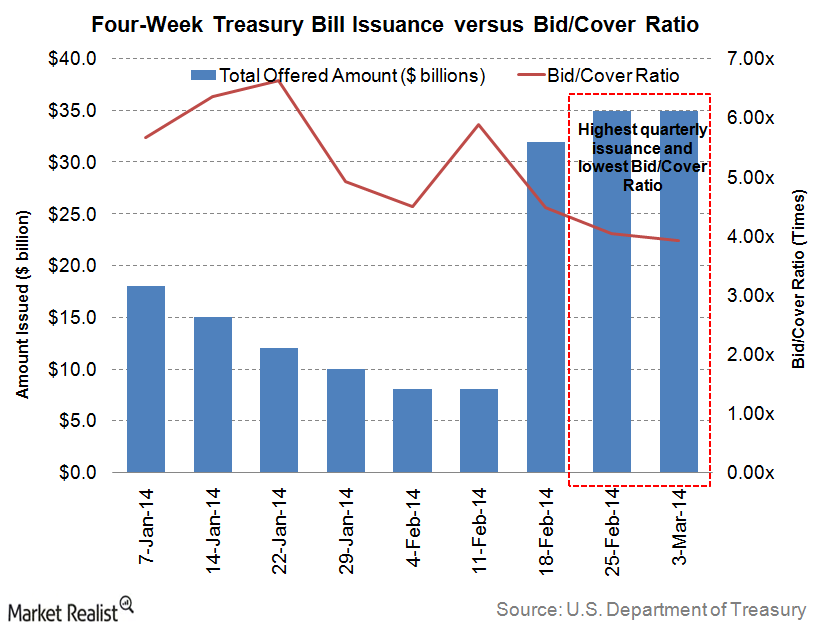

The demand for 4-week Treasury bills remained subdued last week

A considerable amount of $35 billion was offered for the weekly four-week T-bills auctioned on Tuesday, March 4, 2014.

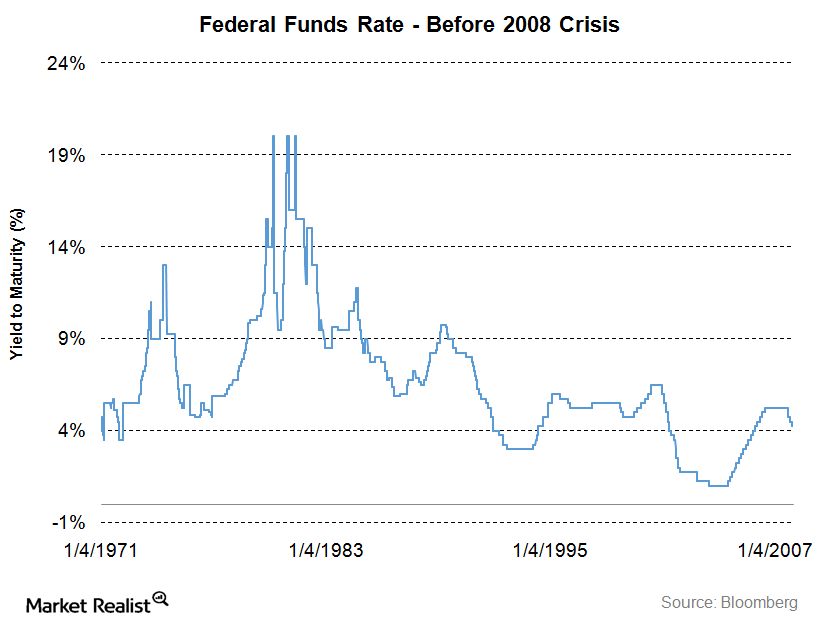

Pianalto’s take on the Fed funds rate before the financial crisis

When consumers can borrow at lower interest rates, they can afford to buy more goods and services, and the businesses that supply those goods and services can hire more people.Healthcare Why dividend recapitalization is the sweet spot for leveraged loans

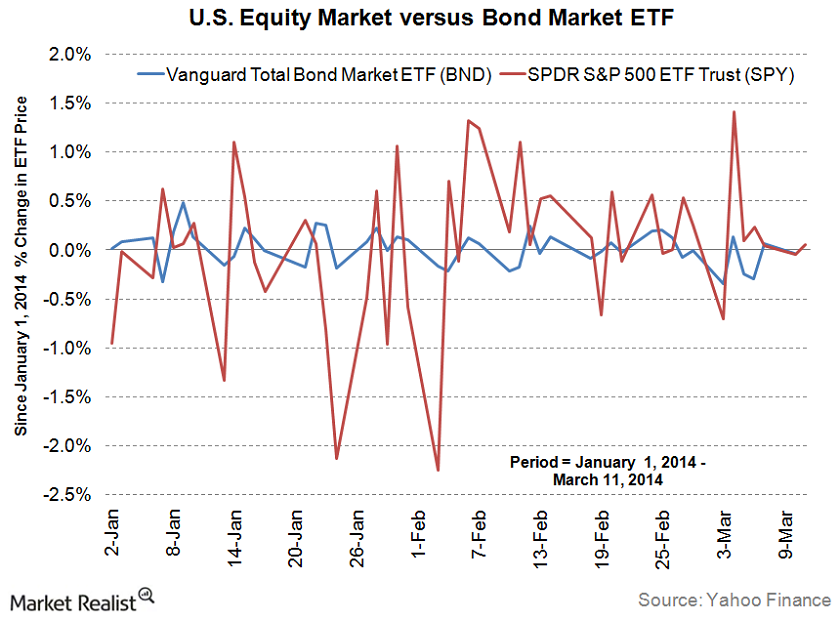

While M&A activity was still below market prospects, demand for dividend recapitalization deals was mostly strong last week.Financials How bond prices, interest rates, and credit spreads correlate

Bond prices and interest rates have an inverse relationship. If an interest rate increases, the price on a bond declines, and vice versa.Financials An investor’s guide to the US leveraged financial market

According to the Securities Industry and Financial Market Association, SIFMA, the total U.S. fixed income market size is about $38.6 trillion.

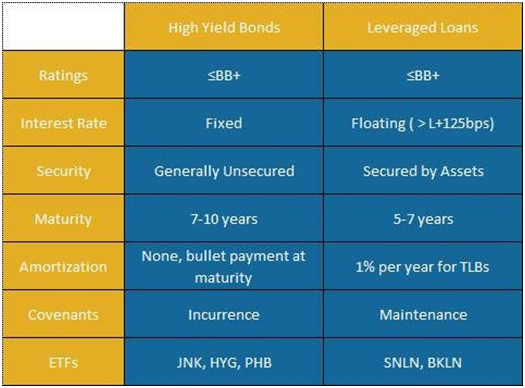

Comparing leveraged loans and high yield bonds: Credit rating

Credit rating measures the credit-worthiness of a debtor with respect to its financial and operational stability. Rating agencies such as Moody’s and Standard & Poor’s specialize in rating credit to government agencies and corporates.Financials Comparing leveraged loans and high yield bonds: Key distinctions

Leveraged loans (BKLN) are almost always secured or backed by a specific pledged asset or some form collateral. On the other hand, high yield bonds (JNK) may be secured or unsecured.Financials Comparing leveraged loans and high yield bonds: Debt terms

Another item that differentiates leveraged loans from high yield bonds is “covenants,” or the financial health metrics that issuers must adhere to.

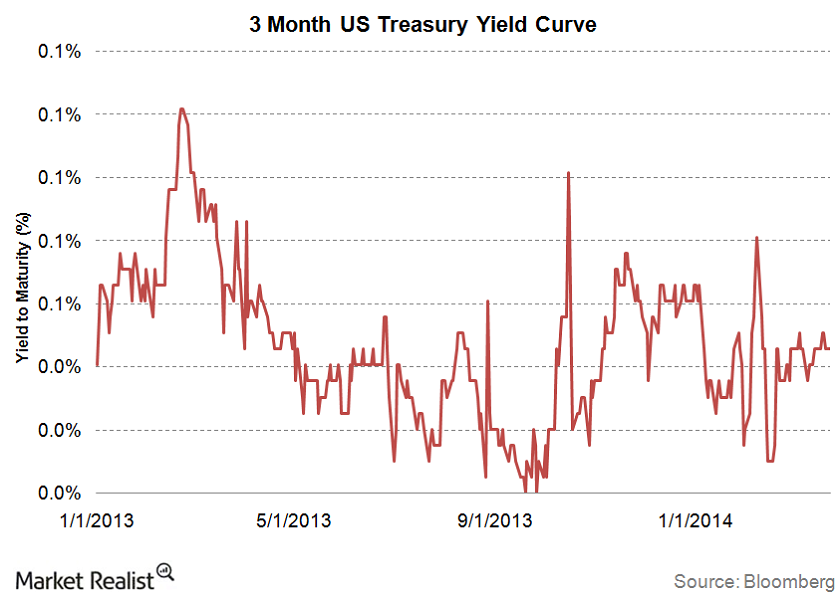

Knowing the Treasury discount rate and yields before investing

Investors can take an informed decision by knowing the rate of return on their investment.Consumer Why tight bidding for bonds favored issuers and refinancing

Most of the deals last week were in the tight ends of the talk, indicating higher demand for high yield bonds (JNK). The higher demand in turn pushes yields down.Energy & Utilities Southwestern is among the largest US oil and natural gas producers

Headquartered in Houston, Texas, Southwestern Energy Corporation (SWN) is one of the largest independent natural gas and oil producers in the United States.

How does the Redbook Index help fixed-income and equity investors?

The Redbook Sales Index compiles and analyzes comparable store sales at more than 9,000 stores.