DE Shaw hedge fund opens new positions in FOXA, NWS, NVE, Sells S, HOG, CCL – 13F Flash (A)

In this six-part series, we will go through each one of the larger positions DE Shaw traded this past quarter DE Shaw is a New York–based $30 billion-plus quantitative hedge fund founded in 1988 by David E. Shaw, a former Columbia faculty member. The firm’s primary trading method is systematic and computer-driven. DE Shaw has […]

Nov. 20 2020, Updated 1:03 p.m. ET

In this six-part series, we will go through each one of the larger positions DE Shaw traded this past quarter

DE Shaw is a New York–based $30 billion-plus quantitative hedge fund founded in 1988 by David E. Shaw, a former Columbia faculty member. The firm’s primary trading method is systematic and computer-driven. DE Shaw has over 1,000 employees in North America, Europe, and Asia, with an international reputation for successful investing based on innovation and strong risk management.

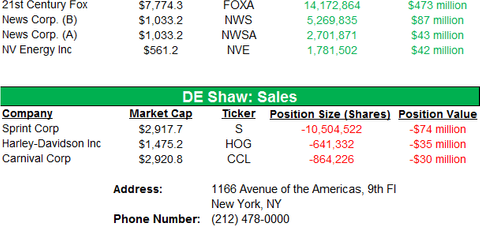

The firm started new positions in Twenty-First Century Fox (FOXA), News Corp. (NWS), and NV Energy (NVE) and sold positions in Sprint Corp. (S), Harley Davidson (HOG), and Carnival Corp. (CCL).

Abbreviated financial summaries and metrics for these securities are included below. Detailed analysis and recommendations require a subscription (more information at the bottom of the article).

Why go long Twenty-First Century Fox?

Overall, the company performed very well this quarter, and could still have potential upside in 2Q14. Twenty-First Century Fox reported Q1 2014 revenue of $7.1 billion—up 18% year-over-year, and EBITDA of $1.62 billion—up 2% year-over-year. The performance was driven by its four divisions, Television, DBS Television, Cable Networks, and Filmed Entertainment. Television reported revenue of $1.05 billion, up 8% year-over-year. DBS Television reported revenue of $1.4 billion, up 68% year-over-year. Cable Networks reported revenue of $2.8 billion, up 12% year-over-year. Finally, Filmed Entertainment reported revenue of $2.12 billion, up 9% year-over-year.

In terms of EBITDA, Television reported $231 million (up 30% year-over-year), DBS Television reported $190 million (up 100% year-over-year), Cable Networks reported $991 million (down 2% year-over-year), and Filmed Entertainment reported $330 million (down 24% year-over-year).

Specifically, Fox’s new sports channel on cable helped the Cable Network Results, driving affiliate revenues higher. Plus, The Wolverine, which grossed $400 million globally, and The Heat, which gross $230 million globally, made the quarter for Filmed Entertainment.

What does FOXA do?

Twenty-First Century Fox, Inc. (formerly known as News Corp.), is a diversified global media and entertainment company with operations in the following five industry segments:

- Cable network programming

- Television

- Filmed entertainment

- Direct broadcast satellite television

- Other, corporate, and eliminations

On June 28, 2013, the company completed the separation of its business into two independent publicly traded companies by distributing to its stockholders shares of the new News Corporation (News Corp.). The company retained its interests in a global portfolio of cable, broadcast, film, pay-TV, and satellite assets spanning six continents. News Corp. holds the company’s former businesses, including newspapers, information services, integrated marketing services, digital real estate services, book publishing, digital education, sports programming, and pay-TV distribution in Australia. (More on Twenty-First Century Fox divisions will follow below.)

FOXA divisions

The company produces and licenses news, business news, sports, general entertainment, and movie programming for distribution—primarily through cable television systems, direct broadcast satellite operators, and telecommunications companies in the United States and internationally.

FOX News owns and operates the FOX News Channel, the top-rated 24/7 all-news national cable channel currently available in more than 97 million U.S. households, according to Nielsen Media Research, as well as the FOX Business Network, which is currently available in more than 74 million U.S. households.

FOX News also produces a weekend political commentary show, FOX News Sunday, for broadcast on local FOX television stations throughout the United States. FOX News, through its FOX News Edge service, licenses news feeds to FOX Affiliates and other subscribers to use as part of local news broadcasts throughout the United States and abroad. FOX News also produces and runs the websites FOXNews.com and FOXBusiness.com and it owns and produces the national FOX News Radio Network, which licenses news updates and long-form programs to local radio stations and satellite radio providers.

Fox Sports Net, Inc. (FSN, Inc.) is the largest regional sports network (or RSN) programmer in the United States, focusing on live professional and major collegiate home team sports events. FSN’s sports programming business currently consists primarily of ownership interests in 15 RSNs, including SportsTime Ohio, and a 49% ownership in the Yankees Entertainment and Sports Network (YES Network), each of which were acquired in December 2012. It also includes numerous sub-regional feeds (FSN RSNs) and National Sports Programming, which operates FSN, a national sports programming service. FSN is affiliated with an additional four RSNs that are not owned by FSN, Inc. (the FSN Affiliated RSNs). FSN provides the FSN RSNs and the FSN Affiliated RSNs with national sports programming, featuring original and licensed sports-related programming, as well as live and replay sporting events. In the aggregate, the FSN RSNs and the FSN Affiliated RSNs currently have approximately 83 million subscribers and have rights to telecast live games of 51 of the 81 U.S. professional sports teams in Major League Baseball (the MLB), the National Basketball Association (the NBA), and the National Hockey League (the NHL), as well as collegiate conferences and numerous college and high school sports teams.

In August 2013, the company plans to launch Fox Sports 1, a multi-sport national cable network. In its inaugural year, Fox Sports 1 will feature over 650 live events, including college football and basketball, the UEFA Champions League and other premier soccer events, the National Association of Stock Car Auto Racing (NASCAR), Ultimate Fighting Championship (UFC), and beginning in 2014, regular and post-season MLB games. Plus, Fox Sports 1 will premiere a nightly multi-hour live national sports news show, Fox Sports Live, and original and documentary programming as well as daily studio programming, including Fox Football Daily and Crowd Goes Wild.

Currently reaching close to 100 million U.S. households, according to Nielsen Media Research, FX is a general entertainment network that telecasts a growing roster of original series as well as acquired television series and motion pictures. FX’s lineup for the 2013–2014 season includes the critically acclaimed Sons of Anarchy, Justified, American Horror Story, and The Americans, as well as the first season of The Bridge. Also included in the 2013–2014 season line-up are the comedies Archer, Louie, and Wilfred and the continuing series Anger Management. FX televises syndicated series, including Two and a Half Men and How I Met Your Mother. It showcases the television premieres of theatrical motion pictures, which in 2013–2014 will include True Grit, X-Men: First Class, and Captain America. The company also produces and distributes FX HD, a 24-hour national programming service produced and distributed in high definition.

In September 2013, the company plans to launch FXX, a general entertainment channel aimed primarily at young adults. FXX’s introductory line-up will include the comedy series It’s Always Sunny in Philadelphia, The League, Totally Biased and the premiere season of the animated comedy Chozen. In addition, FXX will showcase the television premieres of an extensive slate of theatrical motion pictures including Bad Teacher, Hangover 2 and Rango, among others.

SPEED is a 24-hour programming service consisting of motorsports programming. SPEED brings viewers season-long coverage of NASCAR races, events, and original programming (including exclusive coverage of the annual NASCAR Sprint All-Star Race and NASCAR Hall of Fame ceremonies), which in the U.S. will appear on Fox Sports 1 after its launch. Plus, SPEED delivers programming from other top racing series, such as Grand American Road Racing, 24 Hours of Le Mans, World of Outlaws, AMA Pro Racing, AMA Supercross, Monster Jam, World Superbike, and MotoGP—many of which instead will be featured on Fox Sports 1 and Fox Sports 2 in the United States after their respective launches. SPEED is distributed to subscribers in Canada and the Caribbean and by Foxtel in Australia. The company also produces and distributes SPEED HD, a 24-hour national programming service produced and distributed in high definition.

FUEL TV is a 24-hour programming service dedicated to thrill-seeking sports, as well as high-energy entertainment programming and the lifestyle surrounding it. FUEL TV covers UFC as well as both competitive and performance action in the arenas of surfing, BMX, and freestyle motocross. Programming includes U.S. and international action sports events and competitions, as well as original series and specials about top athletes. In August 2013, FUEL TV will become Fox Sports 2, a multi-sports national cable network featuring live events from UFC and NASCAR, along with rugby, the Australian Football League, world-class soccer, and motorsports programming.

Fox College Sports consists of three regionally aligned networks—FCS Pacific, FCS Central, and FCS Atlantic. Fox College Sports provides live and delayed collegiate events from the nation’s top collegiate conferences, coaches’ shows, and collegiate highlight and magazine-format programming from the FSN RSNs across the country.

Fox Movie Channel or FXM splits its programming into two day segments. From 3:00 am to 3:00 pm, the network is branded as FMC and airs films from the historic library of Twentieth Century Fox, uncut and commercial free. From 3:00 pm to 3:00 am, the network is branded as FXM and uses FX’s roster of box office blockbuster modern-day films, with revenue generated from advertising. Also featured throughout both day segments are documentaries and original series that explore the moviemaking process from script to screen. During the 2013–2014 season, FXM will showcase the television premieres of the theatrical motion pictures Love and Other Drugs and Water For Elephants, among other titles.

Fox Soccer Channel is an English-language programming service offering comprehensive coverage of world-class soccer. Top properties include the UEFA Champions League and UEFA Europa League, the FA Cup, the CONCACAF Champions League, and the CONCACAF Gold Cup—along with daily soccer news programs, magazine shows, and in-depth coverage of the world’s most popular sport. Much of this programming instead will be featured on Fox Sports 1 and Fox Sports 2 after their respective launches.

Launched in fiscal 2010, Fox Soccer Plus is a premium cable network showcasing nearly 700 exclusive live soccer and rugby competitions. Soccer events include matches from the UEFA Champions League and FA Cup. Rugby coverage includes matches from the Heineken Cup, Aviva Premiership, and the National Rugby League.

The company owns an approximate 51% interest in the Big Ten Network, a 24-hour national programming service dedicated to the collegiate Big Ten Conference and Big Ten athletics, academics and related programming, and Big Ten Network HD, a 24-hour national programming service produced and distributed in HD.

The National Geographic Channels air non-fiction and documentary programming on such topics as natural history, adventure, science, exploration, and culture. The company holds an approximate 70% interest in NGC Network US LLC, which produces and distributes the National Geographic Channel, National Geographic Channel HD, Nat Geo Wild, Nat Geo Wild HD, and Nat Geo Mundo in the United States—with NGT LLC, a subsidiary of the National Geographic Society, holding the remaining interest. National Geographic Channel and National Geographic Channel HD currently reach more than 84 million households in the United States. Nat Geo Wild and Nat Geo Wild HD reach more than 57 million subscribers in the United States, according to Nielsen Media Research.

The Company also distributes programming through its network-branded websites and applications and licenses programming for distribution through the websites and applications of cable television systems, direct broadcast satellite operators, telecommunications companies, and online video distributors. The company’s applications provide live and on-demand streaming of network-related programming, and currently include Big Ten Network’s application, BTN2Go, and the broadband network SPEED2.

Fox International Channels (or FIC) operates, develops, and distributes primarily factual, sports, lifestyle, and general entertainment channels in various countries in Europe, Latin America, Africa, and Asia, including the Fox Channel, Fox Life, FX, Utilisima (which is also distributed in the United States), Fox Crime, FOX Traveller, the Voyage Channel, Fox Sports, STAR World, STAR Movies (also known as Fox Movies Premium in certain countries) and Chinese-language television programming targeted at Chinese-speaking audiences in Asia. These channels are distributed either in HD or in standard definition (or SD)—or, in certain cases, both HD and SD.

FIC owns a 52.2% interest in NGC Network International LLC and NGC Network Latin America LLC (collectively NGC International), with NGT holding a 26.8% interest and a subsidiary of BSkyB holding a 21% interest. NGC International produces and distributes the National Geographic Channel in various international markets. NGC International also produces and distributes the National Geographic Channel HD, the Nat Geo Adventure channel (in both HD and SD), the Nat Geo Wild channel (in both HD and SD), and the Nat Geo Music channel in international markets. The National Geographic Channel is currently shown in 48 languages and in approximately 171 countries internationally, including the United States.

FIC owns a 77.5% equity interest in LAPTV, a partnership that distributes ten premium pay television channels (Moviecity Premieres HD, Moviecity Premieres, Moviecity Action HD, Moviecity Action, Moviecity Family HD, Moviecity Family, Moviecity Hollywood HD, Moviecity Hollywood, Moviecity Classics, and Moviecity Mundo) and four basic television channels (The Film Zone HD, The Film Zone, Cinecanal, and Cinecanal HD) in Latin America (excluding Brazil). These channels primarily feature theatrical motion pictures of Twentieth Century Fox and three other studio partners dubbed in Spanish or shown in English with Spanish subtitles.

FIC owns a 50.1% equity interest in Elite Sports Limited, a company that owns and distributes Baby TV, a 24-hour channel dedicated to infants and toddlers under three years old. The Baby TV channel is currently shown in more than 100 countries, including the United States.

In November 2012, FIC acquired a controlling 51% ownership stake in Eredivisie Media & Marketing CV (or EMM), a media company that holds the collective media and sponsorship rights of the Dutch Premier League. The remaining 49% of EMM is owned by the Dutch Premier League and the global TV production company Endemol.

FIC owns Fox Pan American Sports LLC, doing business as Fox Sports Latin America (or FSLA), an international sports programming and production entity. FSLA owns and operates the Fox Sports networks in Latin America that comprise Spanish-language sports networks distributed to subscribers in Mexico and certain Caribbean and Central and South American countries. It also does business as Fox Sports Brazil, a Portuguese-language sports network specifically geared to the Brazilian audience. FSLA also owns 100% of Fox Deportes, a Spanish-language sports programming service distributed in the United States. Fox Deportes (formerly known as Fox Sports en Español), has more than 2,100 hours of live and exclusive programming, including exclusive coverage of premiere soccer matches (such as Copa Santander Libertadores and Copa Bridgestone Sudamericana) and MLB, including All-Star, NLCS, and World Series games. Fox Deportes reaches more than 20 million cable and satellite households in the United States, of which almost 6 million are Hispanic.

FIC owns a 50% interest in Mundofox Broadcasting, LLC. This is a joint venture with RCN MF Holdings, Inc., a Latin American television network and production company. In August 2012, the joint venture launched Mundofox, a Spanish-language broadcast television network targeted at the U.S. Hispanic market. Mundofox features original news, original and syndicated entertainment programming, and access to sporting events and programming.

FIC manages Channel [V] Thailand, in which the company owns a 49% interest. Channel [V] Thailand owns a Thai-language music channel. FIC licenses its Channel [V] brand to a third party in Australia to operate a music channel.

FIC has a joint venture with CJ E&M (formerly CJ Media), a Korean media conglomerate for the distribution of the M channel, a 24-hour general entertainment channel featuring Korean content, such as original dramas, variety shows, reality shows, and lifestyle programs.

In July 2012, FIC entered into a joint venture with TV Bank Corporation for the operation of the Japanese-language pay-TV sports channel Fox Sports. FIC owns a 60% interest in the joint venture.

STAR India develops, produces, and broadcasts 44 channels in seven languages, which are distributed primarily via satellite to local cable, Internet protocol television (or IPTV), and direct-to-home (or DTH) operators for distribution throughout Asia, the United Kingdom, Continental Europe, North America, and parts of Africa to its subscribers. STAR India’s primary sources of programming for its channels include original programming produced, commissioned, or acquired by STAR India. STAR India also owns a Hindi film library comprising approximately 1,273 titles, a South Indian–languages film library comprising approximately 2,572 titles, a Bengali film library comprising approximately 267 titles, a Marathi film library comprising approximately 158 titles, a Hindi television program library comprising approximately 759 titles, a South Indian–languages program library comprising approximately 4,278 titles, a Bengali program library comprising approximately 144 titles, a Marathi program library comprising approximately 77 titles, an English-language program library comprising approximately 262 titles, and an English-language film library comprising approximately 720 titles. STAR India’s channels include the flagship Hindi general entertainment channels STAR Plus, Life OK, and Channel V, the Hindi movie channels Star Gold and Movies OK, the English general entertainment channels Star World, FX, and Fox Crime, the English movie channels Star Movies and Star Movies Action, the Bengali general entertainment channel STAR Jalsha, the Bengali movie channel Jalsha Movies, the Marathi general entertainment channel STAR Pravah, and the South Indian–languages general entertainment channels Asianet, Suvarna, and Vijay TV.

In April 2012, STAR India acquired media rights to the BCCI Domestic and International Cricket Series in India for the period from 2012 to 2018.

In January 2009, the company expanded into South Indian regional programming by acquiring a 63% controlling interest in Asianet Communications Limited, a joint venture with Jupiter Capital Private Limited (successor in interest to Asianet TV Holdings Private Limited) and White Water Mass Media Private Limited, which holds the company’s stake in the Tamil-language channel Vijay (through Vijay Television Private Limited). In June 2013, the company acquired the 19% interest in Vijay Television Private Limited that it did not already own and, as a result, the company owns 87% of Asianet Communications. In addition to the Vijay channel, Asianet Communications broadcasts and operates the Malayalam-language channels Asianet and Asianet Plus and the Kannada-language channel Suvarna.

The company also owns an approximate 26% stake in Balaji Telefilms Limited, which is one of the largest television content production companies in India, the shares of which are listed on The Stock Exchange, Mumbai, and the National Stock Exchange of India. Balaji currently produces serials broadcast on general entertainment channels in India.

The company also holds an approximate 30% interest in Tata Sky Limited, which owns and operates a DTH platform in India. The company has a 50/50 joint venture, Star Den, with Den Networks Limited to perform channel placement services in India. In May 2011, Star Den entered into a 50/50 joint venture with Zee Turner Limited and Zee Entertainment Enterprises Limited (or ZEEL) to distribute and market all channels owned by the company and ZEEL, their respective affiliated channels, and other third-party channels in India, Nepal, and Bhutan.

The company has an approximate 19% interest in Rotana Holding FZ-LLC, which operates a diversified film, television, audio, advertising and entertainment business across the Middle East and North Africa. The company also has an approximate 36% interest in Moby Group Holdings Limited (or MGH). MGH operates television, radio, production, and other media businesses in Afghanistan and elsewhere in Central and South Asia.

In November 2012, the company acquired the remaining 50% interest in ESPN STAR Sports, now operating as Fox Sports Asia, that it did not already own for approximately $220 million net of cash acquired. Fox Sports Asia is the leading sports broadcaster in Asia and operates 27 channels in different languages.

The company continues to own an approximate 12% interest in Phoenix Satellite Television Holdings Limited, a company listed on the Main Board of The Stock Exchange of Hong Kong Limited, after it sold an approximate 5% interest in Phoenix in March 2013 through a share placement. Phoenix owns and operates Chinese-language general entertainment, movie, and current affairs channels, all of which are targeted at Chinese audiences around the world and are primarily distributed on a free or an encrypted basis via pay-television platforms in Asia, Europe, and the United States. Phoenix also operates a new media business, which is listed on the New York Stock Exchange, and an outdoor advertising business.

The company owns an approximate 6.7% interest in PT Visi Media Asia Tbk, a company listed on the Indonesia Stock Exchange in November 2011. PT Visi Media Asia Tbk owns and operates television channels and an online news portal, all of which target audiences in Indonesia.

Competition in cable network programming

Cable network programming is a highly competitive business. Cable networks compete for distribution and, when distribution is obtained, for viewers and advertisers with free-to-air broadcast television, radio, print media, motion picture theaters, DVDs, Blu-ray high definition format discs (Blu-rays), Internet, wireless and portable viewing devices, and other sources of information and entertainment. Important competitive factors include the prices charged for programming, the quantity, quality, and variety of programming offered, and the effectiveness of marketing efforts.

FOX News Channel’s primary competition comes from the cable networks CNN, HLN (CNN’s Headline News), and MSNBC. Fox Business Network’s primary competition comes from the cable networks CNBC and Bloomberg Television. FOX News Channel and FOX Business Network also compete for viewers and advertisers within a broad spectrum of television networks, including other non-news cable networks and free-to-air broadcast television networks.

A number of basic and pay television programming services, such as ESPN and NBC Sports Network, as well as free-to-air stations and broadcast networks, provide programming that also targets the FSN RSNs’ audience. FSN is the leading programming service distributing a full range of sports programming on both a national and regional level. On a national level, FSN’s primary competitor is ESPN and, to a lesser extent, ESPN2, NBC Sports Network, and CBS Sports Net. In regional markets, the FSN RSNs compete with other regional sports networks, including those operated by team owners, cable television systems, local broadcast television stations, and other sports programming providers and distributors.

Also, the FSN RSNs and FSN compete, to varying degrees, for sports programming rights. The FSN RSNs compete for local and regional rights with local broadcast television stations, other local and regional sports networks, including sports networks launched by team owners, and distribution outlets, such as cable television systems. FSN competes for national rights principally with a number of national cable services that specialize in or carry sports programming, including sports networks launched by the leagues and conferences, and television “superstations” that distribute sports. Independent syndicators also compete by acquiring and reselling such rights nationally, regionally, and locally. Distribution outlets, such as cable television systems, sometimes contract directly with the sports teams in their service area for the right to distribute a number of those teams’ games on their systems. In certain markets, the owners of distribution outlets, such as cable television systems, also own one or more of the professional teams in the region, increasing their ability to launch competing networks and also limiting the professional sports rights available for acquisition by FSN RSNs.

FX faces competition from a number of basic cable and pay television programming services, such as USA, TNT, Spike TV, Home Box Office, Inc. (HBO), and Showtime Networks Inc. (Showtime)—as well as free-to-air broadcast networks and Internet subscription and rental services that provide programming that targets the same viewing audience as FX. FX also faces competition from these programming services in the acquisition of distribution rights to movie and series programming.

National Geographic Channel and Nat Geo Wild face competition for viewers and advertising from a number of basic cable and broadcast television channels, such as Discovery Channel, History Channel, Animal Planet, Travel Channel, Science Channel, H2, Military Channel, Biography, and Tru TV—as well as free-to-air broadcast networks and sports or news and general entertainment networks that have acquired or produced competing programming.

Internationally, the company’s cable businesses compete with various local and foreign television services providers and distribution networks for audiences, advertising, content acquisition, and distribution platforms.

In India, the pay television broadcasting industry has several participants, and STAR India’s entertainment channels compete with both pay and free-to-air channels since they’re delivered by common cable, direct-to-home, and IPTV. STAR India also competes in India to acquire Hindi and other Indian-languages film and programming rights, and internationally for English-language film and programming rights.

Television

The company operates broadcast television stations and the broadcasting of network programming in the United States.

Fox Television Stations

Fox Television Stations, Inc., owns and operates 28 full-power stations, including stations located in nine of the top ten largest designated market areas (or DMAs). Fox Television Stations owns and operates duopolies in ten DMAs, including the three largest DMAs—New York, Los Angeles, and Chicago.

Of the 28 full-power stations, 18 stations are affiliates of FOX. For a description of the programming offered to FOX Affiliates, see “—FOX Broadcasting Company.” In addition, Fox Television Stations owns and operates ten stations affiliated with Master Distribution Service, Inc. (MyNetworkTV).

FOX Broadcasting Company

FOX has 205 FOX Affiliates, including 18 stations owned and operated by the company, which reach approximately 99% of all U.S. television households. In general, each week, FOX regularly delivers to its affiliates 15 hours of prime-time programming and 90 minutes of late-night programming on Saturday. FOX’s prime-time programming features such series as New Girl, The Following, Raising Hope, The Simpsons, Bones, The Mindy Project, and Glee plus the upcoming return of the thriller 24. It also features unscripted series such as American Idol, X Factor, and So You Think You Can Dance?, plus various specials.

A significant component of FOX’s programming consists of sports programming, with FOX providing to its affiliates live coverage (including post-season) of the National Football Conference of the NFL and MLB, as well as live coverage of the Sprint Cup Series of NASCAR and college football, UFC, and international soccer. FOX also airs a two-hour block of direct-response programming on Saturday mornings provided by Worldlink Ventures, a media sales firm. FOX’s agreement with Worldlink extends through the 2014–2015 broadcast season.

FOX’s prime-time line-up is intended to appeal primarily to target audiences of 18-to-49-year-old adults, the demographic group that advertisers seek to reach most often, with an emphasis on the difficult-to-reach 18-to-34-year-old adult demographic coveted by advertisers. During the 2012–2013 traditional September-to-May broadcast season, FOX ranked first in prime-time programming among adults ages 18 to 34 and second in prime-time programming based on viewership of adults ages 18 to 49 (based on Live+7 ratings). This is the 11th consecutive year FOX has ranked first among adults aged 18 to 34 (2002–2003 to 2012–2013) and the 13th consecutive year FOX has ranked first among teens aged 12 to 17 (2000–2001 to 2012–2013). FOX has ranked first among adults ages 18 to 49 for eight of the past ten years. The median age of the FOX viewer is 46 years, compared to 49 years for NBC, 53 years for ABC, and 55 years for CBS.

FOX obtains programming from major television studios and independent television production companies pursuant to license agreements. The terms of those agreements generally provide FOX with the right to broadcast a television series for a minimum of four seasons.

The company obtains national sports programming through license agreements with professional or collegiate sports leagues or organizations. FOX’s current licenses with the NFL, MLB, college football conferences, NASCAR, and UFC are secured by long-term agreements, including recent extensions of the NFL, MLB, and NASCAR national rights.

FOX provides programming to FOX Affiliates in accordance with affiliation agreements of varying durations, which grant to each affiliate the right to broadcast network television programming on the affiliated station. These agreements typically run three or more years and have staggered expiration dates. These affiliation agreements generally require FOX Affiliates to carry FOX programming in all periods in which FOX programming is offered to those affiliates, subject to certain exceptions.

FOX also distributes programming through its network-branded website and FoxNow application and licenses programming for distribution through the websites and applications of cable television systems, direct-broadcast satellite operators, telecommunications companies, and online video distributors.

MyNetworkTV

At the beginning of the 2009–2010 television season, MyNetworkTV transitioned to a new programming distribution service, Master Distribution Service, Inc., distributing two hours per night of original and off- network programming from 20th Television and other third-party syndicators to its affiliates. As of June 30, 2013, MyNetworkTV had 177 affiliates, including ten stations owned and operated by the company, reaching approximately 96% of U.S. households.

Competition in television

The network television broadcasting business is highly competitive. FOX and MyNetworkTV compete with other broadcast networks, such as ABC, NBC, CBS, and The CW Television Network, independent television stations, cable and DBS program services, and other media—including DVDs, Blu-rays, digital video recorders (DVRs), video games, print, and the Internet for audiences, programming, and advertising revenues. Plus, FOX and MyNetworkTV compete with other broadcast networks and other programming distribution services to secure affiliations or station agreements with independently owned television stations in markets across the United States. ABC, NBC, and CBS each broadcast a significantly greater number of hours of programming than FOX, and accordingly, they may designate or change periods in which programming is broadcast with greater flexibility. Also, future technological developments may affect competition within the television marketplace.

Each of the stations owned and operated by Fox Television Stations also competes for advertising revenues with other television stations and radio and cable systems in its respective market area and with other advertising media, such as newspapers, magazines, outdoor advertising, direct mail, and Internet websites. All of the stations owned and operated by Fox Television Stations are located in highly competitive markets. Additional elements that are material to the competitive position of each of the television stations include the management experience, authorized power, and assigned frequency of that station. Competition for sales of broadcast advertising time is based primarily on the anticipated and actually delivered size and demographic characteristics of audiences as determined by various rating services, price, the time of day when the advertising is broadcast, competition from other networks, cable television systems, DBS services, and other media and general economic conditions. Competition for audiences is based primarily on programming selection, which depends on the reaction of the viewing public—often difficult to predict.

Filmed entertainment

The company produces and acquires live-action and animated motion pictures for distribution and licensing in all formats in all entertainment media worldwide and produces and licenses television programming worldwide.

Feature film production and distribution

One of the world’s largest producers and distributors of motion pictures, Twentieth Century Fox Film (or TCFF) produces, acquires, and distributes motion pictures throughout the world under a variety of arrangements. During fiscal 2013, TCFF placed 21 motion pictures in general release in the United States. The motion pictures of TCFF are produced or distributed by the following units of TCFF: Twentieth Century Fox and Fox 2000, which produce and acquire motion pictures for mainstream audiences; Fox Searchlight Pictures, which produces and acquires specialized motion pictures; and Twentieth Century Fox Animation, which produces feature length animated motion pictures. Also, Fox International Productions co-produces, co-finances, and acquires local-language motion pictures intended for distribution outside the United States.

The motion pictures produced or distributed by TCFF in the United States and international territories in fiscal 2013 included Ice Age: Continental Drift, Taken 2, Life of Pi, A Good Day to Die Hard and The Heat. TCFF has already released or currently plans to release approximately 23 motion pictures in the United States in fiscal 2014, including The Wolverine, Secret Life of Walter Mitty, Maze Runner, Rio 2, The Way, Way Back and The Grand Budapest Hotel.

Pursuant to an agreement with Monarchy Enterprises Holdings B.V. (or MEH), the parent company of New Regency in which the company has a 20% interest, and certain of MEH’s subsidiaries, TCFF distributes certain New Regency films and all films co-financed by TCFF and New Regency in all media worldwide, excluding a number of international territories with respect to television rights. Among its fiscal 2014 releases, TCFF currently expects to distribute three New Regency films.

In fiscal 2013, the company entered into an arrangement to distribute new-release animated motion pictures produced by DreamWorks Animation SKG, Inc. (DWA) as well as certain other library motion pictures and filmed entertainment.

Motion picture companies like TCFF typically seek to generate revenues from various distribution channels. TCFF derives its worldwide motion picture revenues primarily from four basic sources (set forth in general chronology of exploitation):

- Distribution of motion pictures for theatrical exhibition in the United States and Canada and markets outside of the United States and Canada (international markets)

- Distribution of motion pictures in various home media formats, including digital distribution

- Distribution of motion pictures for exhibition on premium-pay, subscription video-on-demand, pay-per-view, and video-on-demand programming services

- Distribution of motion pictures for exhibition on free television networks, other broadcast program services, independent television stations, and basic cable programming services—including certain services that are affiliates of the company

The company doesn’t always have rights in all media of exhibition to all motion pictures that it releases, and it doesn’t necessarily distribute a given motion picture in all of the foregoing media in all markets.

The company believes that the pre-release marketing of a feature film is an integral part of its motion picture distribution strategy and generally begins marketing efforts three to six months in advance of a film’s release date in any given territory. The company markets and distributes its films worldwide, principally through its own distribution and marketing companies.

Through Twentieth Century Fox Home Entertainment LLC, the company distributes motion pictures and other programming produced by units of TCFF, its affiliates, and other producers in the United States, Canada, and international markets in all home media formats, including the sale and rental of DVDs and Blu-rays. In fiscal 2013, the domestic home entertainment division released or re-released approximately 1,230 produced and acquired titles, including 23 new TCFF film releases, approximately 871 catalog titles, and approximately 336 television and non-theatrical titles. In international markets, the company distributed, produced, and acquired titles both directly and through foreign distribution channels, with approximately 934 releases in fiscal 2013, including approximately 22 new TCFF film releases, approximately 663 catalog titles, and approximately 249 television and non-theatrical releases.

In fiscal 2013, the company entered into an arrangement to distribute new-release animated motion pictures produced by DWA as well as certain other catalog motion pictures and programming controlled by DWA. It continued its worldwide home video distribution arrangement with Metro-Goldwyn-Mayer (MGMB), releasing approximately 583 MGM home entertainment theatrical, catalog, and television programs domestically and 611 internationally. The company also continued its domestic home video distribution arrangements with Lions Gate (U.S. only) and Anchor Bay Entertainment, LLC (U.S. and Canada), releasing approximately 1,604 Lions Gate home entertainment theatrical, catalog, and television programs and approximately 683 Anchor Bay home entertainment theatrical, catalog, and television programs. During fiscal 2013, the domestic home entertainment division released 403 Blu-ray titles, including 23 new TCFF film releases, 309 catalog titles, and 71 television and non-theatrical releases. In international markets, the Company released 268 Blu-ray titles, including 22 new TCFF film releases and 246 catalog titles. The company also distributed 185 Blu-ray titles from MGM domestically and 112 titles internationally, 298 Blu-ray titles from Lions Gate domestically, and 217 Blu-ray titles from Anchor Bay domestically.

Units of TCFF license motion pictures and other programs in the United States and international markets to various third-party and certain affiliated subscription services. These include pay-television, subscription video-on-demand, pay-per-view, video-on-demand, and electronic sell-through services—as well as free television networks and basic cable programming services for distribution by various media. This which may include direct broadcast satellite (or DBS), cable television systems, and the Internet.

The license agreements reflecting the subscription pay television arrangements generally provide for a specified number of exhibitions of the program during a fixed term in exchange for a license fee based on a variety of factors. These factors include the box office performance of each program and the number of subscribers to the service or system. Among third-party license arrangements that units of TCFF have in place in the United States for subscription pay-television motion pictures exhibition is an exclusive license agreement with HBO, providing for the licensing of films initially released for theatrical exhibition.

Units of TCFF also license programming to subscription video-on-demand services in the United States. These licenses let the consumer view individual programming they select for a subscription fee, typically on a monthly basis. The license agreements reflecting the pay-per-view and video-on-demand services generally provide for a license fee based on a percentage of the licensee’s gross receipts from showing the program, and in some cases, a guaranteed minimum fee. Plus, these agreements generally provide for a minimum number of scheduled pay-per-view exhibitions per program and for continuous video-on-demand availability of each program to consumers during a fixed period.

Units of TCFF license motion pictures and other programs to third parties for distribution for electronic sell-through. This lets consumers acquire the right to retain these programs permanently. In international markets, units of TCFF license motion pictures and other programming to subscription pay television, subscription video-on-demand, pay-per-view, video-on-demand, and electronic sell-through services operated by leading third parties as well as services operated by various affiliated entities. Also, units of TCFF license motion pictures in international markets for exhibition on free television networks. This includes basic cable programming services, both to independent third-party broadcasters as well as services operated by affiliated entities of the company.

Competition in filmed entertainment

Motion picture production and distribution are highly competitive businesses. The company competes with other film studios, independent production companies, and others for the acquisition of artistic properties, the services of creative and technical personnel, exhibition outlets, and the public’s interest in its products. The number of motion pictures released by the company’s competitors—particularly the other major film studios—in any given period may create an oversupply of product in the market. This may reduce the company’s shares of gross box office admissions and may make it more difficult for the company’s motion pictures to succeed.

The commercial success of the motion pictures produced or distributed by the company is affected substantially by the public’s unpredictable response. The competitive risks affecting the company’s home entertainment business include the number of home entertainment titles released by the company’s competitors that may create an oversupply of product in the market, competition among home media formats (such as DVDs and Blu-rays), and other methods of distribution, such as electronic sell-through and video-on-demand services.

Television programming, production, and distribution

During fiscal 2013, Twentieth Century Fox Television (TCFTV) produced television programs for FOX, FX Networks, LLC (or FX), ABC Television Network (ABC), CBS Broadcasting, Inc. (CBS), NBC Television Network (NBC), Comedy Partners (Comedy Central), Showtime, Netflix, and the Independent Film Channel (IFC). TCFTV currently produces, or has orders to produce, episodes of the following television series: 24, American Dad, Bob’s Burgers, Bones, Dads, Enlisted, Family Guy, Gang Related, Glee, Murder Police, New Girl, Raising Hope, The Simpsons, and Sleepy Hollow for FOX; Sons of Anarchy and American Horror Story for FX; Back in the Game, Last Man Standing, Mind Games, and Modern Family for ABC; The Crazy Ones, Friends with Better Lives, and How I Met Your Mother for CBS; Crisis for NBC; Homeland for Showtime; Brickleberry for Comedy Central; Salem for WGN America; Those Who Kill for A&E Network; Legends for Turner Network Television; and Witches of East End for Lifetime. Generally, a television network or cable network will license a specified number of episodes for exhibition during the license period. All other distribution rights, including international and off-network syndication rights, are typically retained by TCFTV, used by other units of the company, or sold to third parties.

Television programs are generally produced under contracts that provide for license fees that may cover only a portion of the anticipated production costs. As these costs have increased in recent years, the resulting deficit between production costs and license fees for domestic first-run programming also has increased. So additional licensing is often critical to the financial success of a series. Successful U.S. network television series are typically:

- Licensed for first-run exhibition in international markets

- Released in DVD and Blu-ray box sets

- Licensed for subscription video-on-demand, video-on-demand, and pay-per-view services

- Licensed for off-network exhibition in the United States (including in syndication and to cable programmers)

- Licensed for further television exhibition in international markets

- Made available for electronic sell-through and streaming, including individual episodes and full series

Typically, a series must be broadcast for at least three to four television seasons for there to be a sufficient number of episodes to offer the series in syndication or to cable and DBS programmers in the United States. The decision of a television network to continue a series through an entire television season or to renew a series for another television season depends largely on the series’ audience ratings.

Twentieth Television licenses both television programming and feature films for domestic syndication to television stations and basic cable services in the United States. Twentieth Television distributes a program portfolio that includes the company’s library of television and film assets, and first-run programming produced by its production companies for sales to local stations, including stations owned and operated by the company, as well as to basic cable networks. First-run programs distributed by Twentieth Television include the court shows Divorce Court and Judge Alex and the entertainment magazine program Dish Nation.

The company also has a motion picture and TV library

Direct Broadcast Satellite Television

The company direct-broadcasts satellite business through its wholly owned subsidiary, SKY Italia, and its majority-owned subsidiary, Sky Deutschland AG. The company also owns a significant equity interest in BSkyB, which is in the DBS business (for a description of its business, please see the discussion under heading “Equity interests”).

SKY Italia

SKY Italia currently distributes more than 190 channels of basic, premium, and pay-per-view programming services via satellite and broadband directly to subscribers in Italy. This programming includes exclusive rights to popular sporting events, newly-released movies, and SKY Italia’s original programming, such as SKY TG 24, Italy’s first 24-hour news channel. As of June 30, 2013, SKY Italia had approximately 4.76 million subscribers.

Sky Deutschland

In January 2013, the company increased its ownership in Sky Deutschland to 55%. This network is the leading pay television operator in Germany and Austria. Sky Deutschland currently distributes more than 70 channels of basic, premium, and pay-per-view programming services via satellite and cable to subscribers in Germany and Austria. Viewers can also receive Sky Deutschland via Teleclub in Switzerland. Sky Deutschland’s program offering includes current feature films, new series, children’s channels, documentaries, and live sports, such as the German Bundesliga and UEFA Champions League. As of June 30, 2013, Sky Deutschland had approximately 3.45 million subscribers.

Competition with DBS

SKY Italia and Sky Deutschland compete with companies that offer video, audio, interactive programming, telephony, data, and other information and entertainment services, including broadcasters of free-to-air television channels, broadband Internet providers, digital terrestrial transmission (or DTT) services, wireless companies, and companies that are developing new media technologies.

Other, Corporate, and Eliminations

The Other, Corporate, and Eliminations segment consists of corporate eliminations and other businesses.

Equity interests

BSkyB

The company holds an approximate 39% interest in BSkyB. BSkyB’s ordinary shares are listed on the London Stock Exchange under the symbol BSY. BSkyB is the UK’s leading entertainment and communications provider, operating the most comprehensive multichannel, multi-platform pay television service in the UK and Ireland. BSkyB retails subscription television and communications services to residential and commercial premises in the UK and Ireland.

In addition to the retail operations, BSkyB operates a number of other businesses, including wholesaling its channel portfolio, selling advertising on its own and partner channels, and the Sky betting and gaming business.

In June 2010, the company announced that it had proposed to the board of directors of BSkyB to make a cash offer of 700 pence per share for the BSkyB shares that the company doesn’t already own. Following the allegations regarding The News of the World, on July 13, 2011, the company announced that it no longer intended to make an offer for the BSkyB shares. As a result of the July 2011 announcement, the company paid BSkyB a breakup fee of approximately $63 million in accordance with a cooperation agreement between the parties.

YES Network

In December 2012, the company acquired a 49% equity interest in YES Network, an RSN, for approximately $584 million. Simultaneous with the closing of this transaction, the company paid approximately $250 million of upfront costs on behalf of the YES Network. The YES Network delivers exclusive live local television coverage of New York Yankees baseball and Brooklyn Nets basketball, as well as other leading local and national sports-related programming. Starting in December 2015, the remaining partners can exercise a put option that would require the company to acquire up to an additional 31% interest. If the put option isn’t exercised, the company has a call option beginning in December 2016 that would allow it to acquire up to an additional 31% interest.

Hulu

The company has an approximate 33% equity interest in Hulu LLC, which operates an online video service that offers video content from Fox, the other one-third partners in Hulu, NBCUniversal and The Walt Disney Company, as well as over 450 other third-party content licensors. Hulu’s premium programming is available free of charge to viewers at Hulu.com and over 60 destination sites online, including AOL, IMDb, MSN, Myspace, and Yahoo!. Additional premium programming is available on a monthly subscription basis at Hulu.com and through software applications on Internet-connected devices, including smartphones, tablets, gaming consoles, and set-top boxes.

In July 2013, the company, NBCUniversal, and The Walt Disney Company announced that they will maintain their respective ownership positions in Hulu and together provide a cash infusion of $750 million. As result, the company invested an additional $125 million in Hulu and has committed to invest an additional $125 million.

CMC-News Asia

The company holds an approximate 47% interest in CMC-News Asia, a joint venture with China Media Capital, which is a media investment fund in China. CMC-News Asia develops general entertainment programming for broadcast on local Chinese channels. CMC-News Asia also broadcasts the Chinese-language Xing Kong and Channel [V] China channels, primarily in China on a free-to-air basis to local cable operators in southern China and three-star and above hotels as well as other approved organizations and institutions. It also sells television, new media, home video, and other rights to its extensive contemporary Chinese film library, comprising over 750 titles.

Bona Film Group

In fiscal 2012, the company acquired a 17% interest in Bona Film Group, a film distributor in China listed on NASDAQ, for approximately $70 million in cash.

More on DE Shaw

Paul Singer created Elliott Associates in January 1977, starting with $1.3 million from friends and family. In its earliest years, the firm focused on convertible arbitrage. However, since the 1987 stock market crash and early 1990s recession, the firm has focused primarily on distressed debt investing, and it’s therefore commonly referred to as a “distressed debt” or “vulture fund.” More recently, the company has focused on activism. The firm’s strategies include: