News Corp

Latest News Corp News and Updates

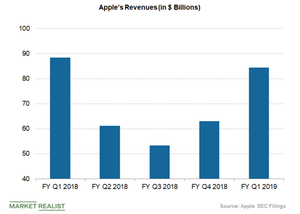

Will Apple’s Launch of News+ Help Boost Its Revenue?

On March 25, during an event held in Cupertino, California, Apple launched its news and magazine subscription service, News+.

Eric Schmidt Parts Ways with Google and Alphabet

Former Google CEO Eric Schmidt has cut ties with the company and its parent Alphabet. He served as Google’s CEO from 2001 to 2011.

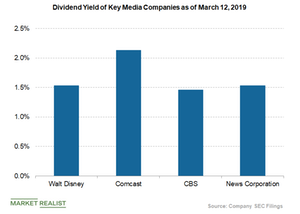

Why Did S&P Downgrade Disney’s Rating?

On March 12, S&P Global Ratings reportedly downgraded the Walt Disney Company (DIS) to an A from an A+.

Why Disney Had to Discontinue Its Share Repurchase Program

Disney announced that it would not continue its share repurchase program until it completed its proposed acquisition of media assets from 21st Century Fox.

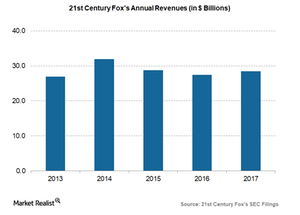

How Will the New Fox Look after the Disney Deal?

21st Century Fox (FOXA) will be left with news and sports assets after selling most of its assets to the Walt Disney Company (DIS) in a $52.4 billion deal.

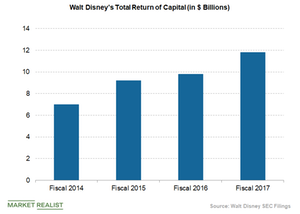

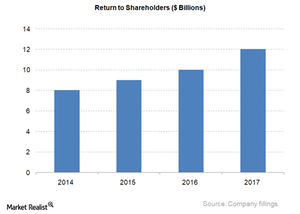

Disney’s Capital Return Policy Looks Attractive

Capital return trends Leading media mogul The Walt Disney Company (DIS) has continued to improve its capital return policy, driven by attractive dividend payments and strong share repurchase programs. In fiscal 2017, the media giant returned ~$11.8 billion to shareholders via buybacks and dividend payments, compared with $9.8 billion in fiscal 2016. In fiscal 2018, the […]