Why phosphate is a less competitive fertilizer sub-industry

The phosphate industry is less competitive than the nitrogen industry Unlike nitrogen-based fertilizers, the production of phosphate and potash fertilizers begins in mines. Mineral deposits for the latter two fertilizers are much scarcer and are usually concentrated in specific regions around the world. Because of this, there are fewer firms that make up the two […]

Oct. 16 2013, Published 4:52 p.m. ET

The phosphate industry is less competitive than the nitrogen industry

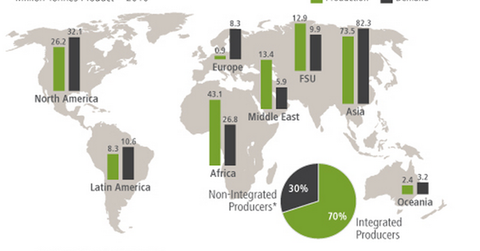

Unlike nitrogen-based fertilizers, the production of phosphate and potash fertilizers begins in mines. Mineral deposits for the latter two fertilizers are much scarcer and are usually concentrated in specific regions around the world. Because of this, there are fewer firms that make up the two sub-industries, which makes them less competitive compared to the nitrogenous fertilizer sub-industry.

Starting point: Phosphate rock

Phosphate-based fertilizer production begins with mining phosphate rock. These are rocks that contain the chemical element phosphorous, currently produced in countries like the United States, China, Morocco, Russia, and South Africa as well as some countries in the Middle East. In the United States, approximately 85% of the rock is mined in Florida and Utah. So you can expect several phosphate producers like Mosaic Co. (MOS), Potash Corp. (POT), and CF Industries Holdings Inc. (CF) to have plants near the region.

From phosphoric rock to acid to DAP/MAP

Phosphate rocks are processed with sulfuric acid to produce phosphoric acids, which are further processed into DAP and MAP by mixing ammonia (the two common fertilizers that are primary sources of phosphorus and a secondary source of nitrogen for plants). About 3.5 mt (metric tonnes) of phosphate rock is required to produce a tonne of phosphoric acid, and ~1.65 mt is necessary to produce a tonne of DAP.

Fun fact: Coca-Cola uses phosphoric acid to add an acidic feel to its beverages.

Producers’ integration level

About 70% of the world’s phosphate fertilizer producers are integrated. This means the firms own phosphate rock mines and not just the manufacturing plants that produce DAP and MAP from phosphoric acid—most of which are included under the VanEck Vectors Agribusiness ETF (MOO). Companies like POT, MOS, and CF are vertically integrated and use most of their mines to produce about 95% or more of its fertilizers. Although Agrium Inc. (AGU) also has mineral deposits, it currently has a contract obligation to purchase some 798,000 mt of phosphate rock between 2014 and 2018 from Morocco since its Kapuskasing mine was depleted in 2013.