Key inputs and processes of nitrogenous fertilizer production

The importance of costs Understanding how fertilizers are produced is an important part of investing. What companies buy and what they pay for will be their costs. When costs are rising, they can have a negative impact on earnings and cash flow if the industry can’t pass them on to buyers. Conversely, when costs are falling, […]

Nov. 27 2019, Updated 1:09 p.m. ET

The importance of costs

Understanding how fertilizers are produced is an important part of investing. What companies buy and what they pay for will be their costs. When costs are rising, they can have a negative impact on earnings and cash flow if the industry can’t pass them on to buyers. Conversely, when costs are falling, they can have a positive impact on the earnings and cash flow of nitrogenous fertilizer producers such as CF Industries Holdings Inc. (CF), Terra Nitrogen Company LP (TNH), Agrium Inc. (AGU), and Potash Corp. (POT).

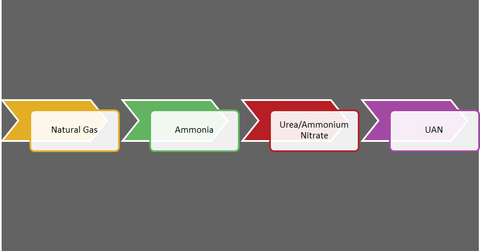

From natural gas to product

The most common way to produce nitrogen-based fertilizers is through a process called the Haber-Bosch process, which was invented in 1915. It uses natural gas as a major input, combined with high heat pressure, to form ammonia—the basis of all nitrogenous fertilizers. Ammonia is often further processed into products like urea by reacting with carbon dioxide at high temperatures or ammonium nitrate, two products that are commonly used as fertilizers. Depending on demand, UAN (urea ammonium nitrate) could be produced. It takes about 36.1 MMBtu (million British thermal units) of natural gas to produce a metric tonne of ammonia, and ~0.58 metric tonnes of ammonia as well as a natural gas processing requirement of 5.2 MMBtu to produce a metric tonne of urea. Since natural gas is the main raw material used to produce these fertilizers, the cost of natural gas generally makes up ~40% to 70% of total manufacturing cost.

Resource locations

As a resource, natural gas is available pretty much anywhere. But the largest reserves are held in Russia, the Persian Gulf, North America, Algeria, Nigeria, China, and the North Sea. Natural gas prices differ from location to location based on factors such as government subsidies, pricing methodology, and regional supply and demand as well as cost of extraction. This difference is considerable, ranging from $100 per metric tonne to $350 per metric tonne, with the United States being one of the lower-cost producers for now. So nitrogenous fertilizer producers are often located near areas with favorable natural gas prices or which are expected to have lower natural gas prices in the future.

Competition level

Because of its wide availability, the nitrogenous fertilizer sub-industry is least concentrated compared to the phosphate or potash sub-industries, which makes it more competitive. A producer can’t cut production in the hopes of increasing fertilizer prices because it represents a smaller portion of the industry, and what it doesn’t produce will be another’s business. So coordination is lacking, even though barriers to entry are high because of the upfront costs that commonly fall in the billions. Essentially, investors can think of nitrogenous fertilizer companies as a spread business, where profits depend on the marginal producer’s cost (the cost of the most expensive producer that people are demanding at the time) compared to the company’s own costs.