Market Realist dry bulk shipping blast (Part 6: Forward rates)

Continued from Part 5 What are forward contracts? If there are shipping rates for today, then there’s also the expectation of tomorrow’s rates. Companies use forward contracts to lock in the availability of resources in the future at a set price. The dry bulk shipping industry—which transports key dry bulk materials such as iron ore, coal, […]

Nov. 20 2020, Updated 4:56 p.m. ET

Continued from Part 5

What are forward contracts?

If there are shipping rates for today, then there’s also the expectation of tomorrow’s rates. Companies use forward contracts to lock in the availability of resources in the future at a set price. The dry bulk shipping industry—which transports key dry bulk materials such as iron ore, coal, and grain—is no exception to this practice. When shipping companies negotiate the rates of shipping raw materials, they consider future expected supply and demand. If the rate of renting a ship and service in a forward contract is higher than the current rate, it’s often a positive indication that shipping rates will rise. Higher shipping rates mean higher revenues, earnings, and free cash flows—and vice versa.

Higher forward contract prices

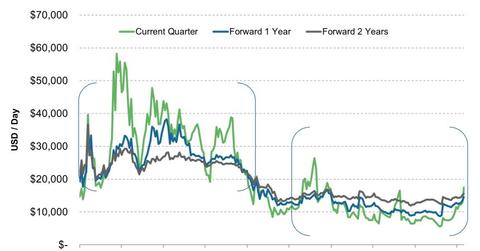

On August 2, the current quarter’s time charter rates for Capesize vessels (ships that mainly haul iron ore and coal) rose from $12,925 to $17,450 per day. That increase has surpassed forward one- and two-year contract rates, which both showed increases from $13,600 to $14,550 and $15,175 to $15,600, respectively. Rates have all drifted lower over the past few years because shipbuilders delivered more than a necessary amount of newbuilds (new ships), driven by companies’ over-optimism toward future profitability. But since last year, shipping rates have started to base because several companies began to report negative earnings, capacity growth improved because of lower new ship deliveries, shipping companies continue to scrap older vessels, and shipment growth continues in dry bulk iron ore shipments.

Unlike before 2010, when people in the industry expected new deliveries to continue to hurt future profitability, contracts that are farther into the future have been priced above nearer-term rates for the past two years. This is happening because people in the industry expect supply growth to fall even farther in 2014 and 2015, as companies plan to allow the current excess capacity condition to alleviate and profitability to improve.

Current rates rise above future rates

More importantly, the current quarter’s time charter rates have now moved above rates for contracts that are farther into the future—something we’ve spoken of in prior articles. This reflects an unexpected increase in short-term demand. While this happened a few times in late 2011 and 2012, increases in one-year and two-year forward contracts didn’t exactly materialize back then. If we continue to see positive upward move in forward one- and two-year rates, Capesize vessels should see a real recovery towards this end of this year.

With additional iron ore capacity coming out of Australia and Brazil, and China’s industrial output remaining positive, we could see positive surprises toward the end of this year in the dry bulk shipping industry. This bodes well for the long-term outlook of dry bulk shipping companies such as DryShips Inc. (DRYS), Diana Shipping Inc. (DSX), Safe Bulkers Inc. (SB), Navios Maritime Partners Inc. (NMM), and Knightsbridge Tankers Ltd (VLCCF), and the market will likely begin pricing them in over the next few months.

Learn more about the key performance indicators of the dry bulk shipping industry

Continue to last week’s article, Ship prices or vessel values, or go back to Part 1 to see the list of key shipping indicators. For curious investors, to read how commodity prices may benefit dry bulk shipping stocks, continue to Must-know: Commodity prices and dry bulk shipping.