Knightsbridge Shipping Ltd

Latest Knightsbridge Shipping Ltd News and Updates

Industrials Dry bulk shipping weekly analysis (Part 3: Construction rises)

Continued from Part 2 Ship construction activity Part 2 of this series explains how ship orders can illustrate managers’ expectations for future supply and demand differentials. But new ship orders don’t always translate into new constructions right away. Sometimes, shipping firms specify a particular date of delivery for the new orders. If the delivery date is farther […]

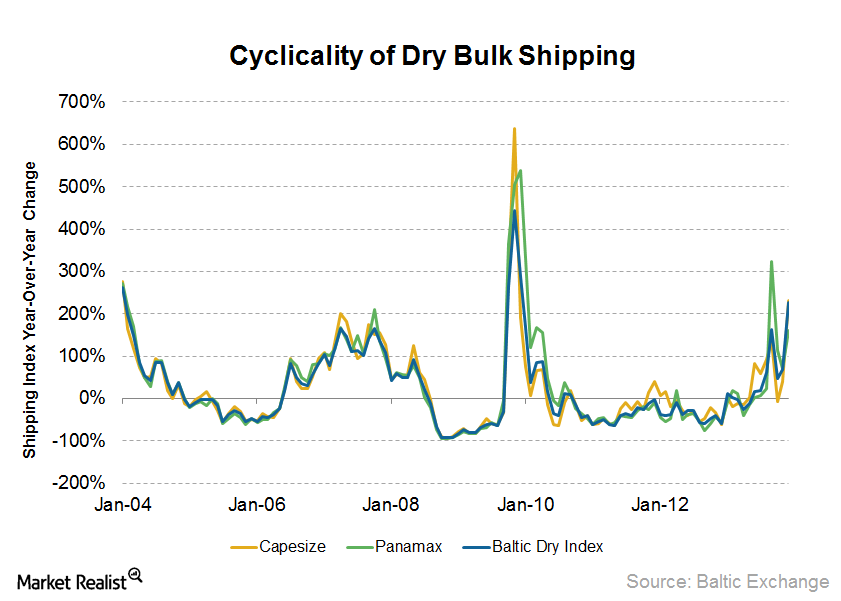

Recommendation: Capitalize on dry bulk shipping’s cyclical waves

The dry bulk shipping industry is cyclical mainly due to economic or business cycles as well as a long lead time between the placement of orders and the delivery of new vessels.

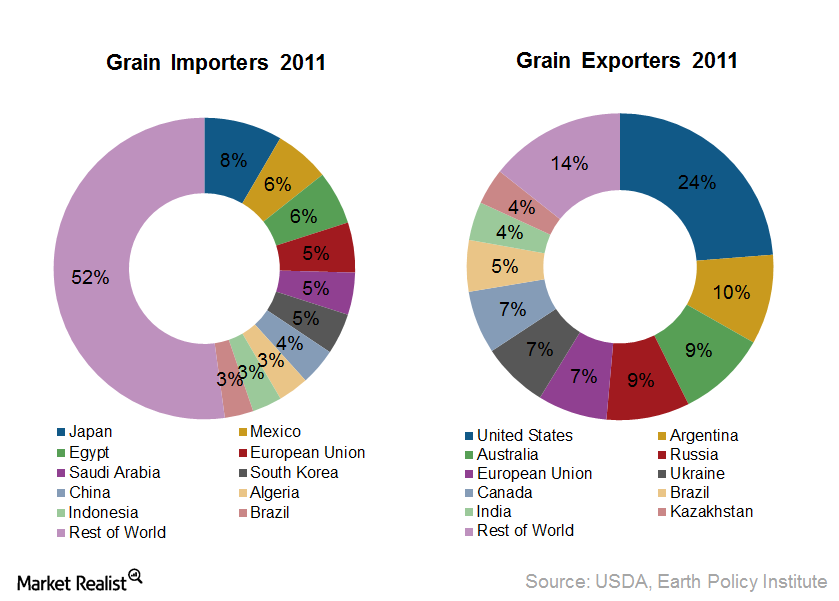

Major importers and exporters of grain and oilseed

Compared to iron ore and coal, the grain and oilseed trade makes up a much smaller part of overall dry bulk shipments—about 10%.

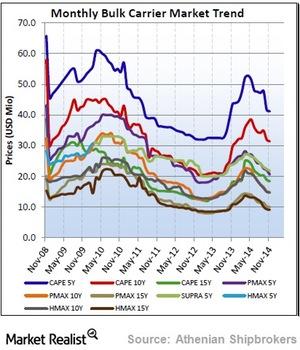

5-year and 10-year ship prices for dry bulk companies

Vessel prices are very close to bottom levels that occurred back in the period from December 2012 to January 2013.