Why the summer heat wave supports natural gas prices

A heat wave that has persisted in the US has helped to lift natural gas prices.

May 3 2021, Updated 10:33 a.m. ET

Demand for natural gas rises in the summer, when power plants generate more electricity to fuel cooling needs

Natural gas is a major fuel used in electricity generation, and therefore demand increases in the summer, when more electricity is used for air conditioning. So hotter than normal weather can increase natural gas usage and consequently natural gas prices. For example, during the summer of 2012, much of the United States experienced record-hot temperatures. Cooling degree days from the week ended May 5 through the week ended September 29 totaled 1,311 compared to an average of 1,079. During that period, natural gas prices rallied from ~$2.30 per MMBtu (millions of British thermal units) to ~$3.30 per MMBtu, partially due to the unusually hot summer. Natural gas price movements especially affect the earnings of major domestic natural gas producers such as Chesapeake Energy (CHK), Range Resources (RRC), Quicksilver Resources (KWK), and Southwestern Energy (SWN). Additionally, many of these companies are part of the energy exchange-traded funds (ETFs) such as the Vanguard Energy ETF (VDE).

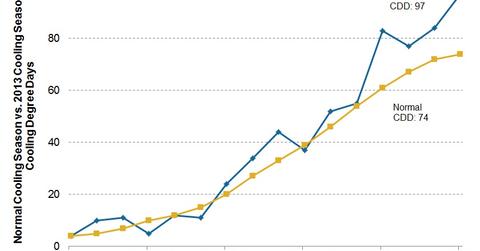

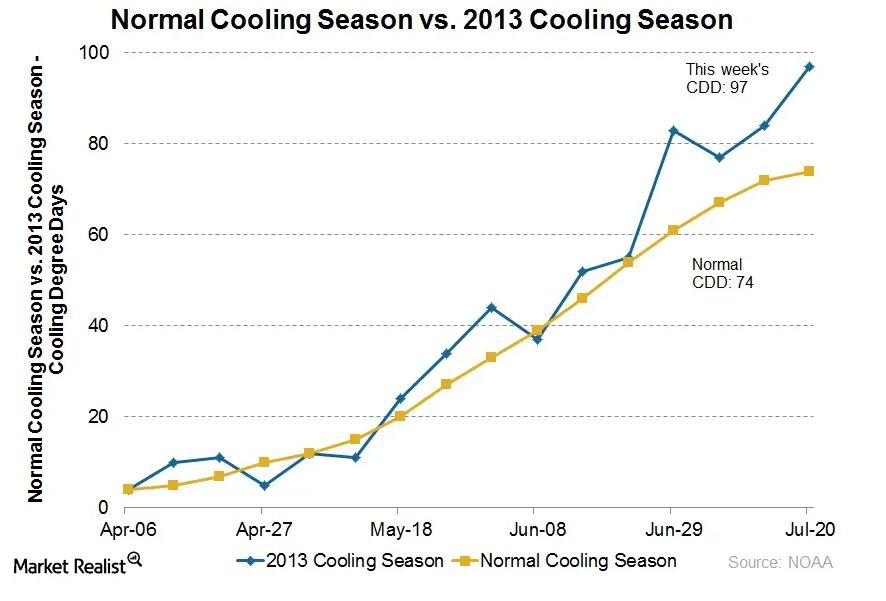

Temperatures have been hotter than average

For the week ending July 20, cooling degree days for the United States totaled 97 versus the normal figure for corresponding weeks in the past of 74. Cooling degree days (CDD) measure how much warmer than room temperature the weather is, and the greater the CDD figure, the hotter it is. This week’s CDD figure was higher than normal, meaning weather was hotter than normal, which implies more natural gas demand and therefore higher natural gas prices. On July 19, natural gas prices finished higher at $3.79 per MMBtu compared to $3.64 per MMBtu on July 12. Hotter temperatures and expectations of sustained hotter weather were a major factor in pushing up gas prices on the week.

Theoretically, higher demand translates into higher natural gas prices, which affects the earnings and valuations of natural gas–weighted producers. The following graph displays natural gas prices over time versus the stock prices of CHK and KWK, two producers whose production is currently weighted towards natural gas. Over the past few years, the equity prices of these companies have trended with natural gas prices.

Positive short-term catalyst for natural gas producers, though prices traded lower on inventory figures

Investors with holdings in natural gas–weighted producers (such as CHK, KWK, RRC, and SWN) or a natural gas ETF such as UNG may find it prudent to monitor weather as an indicator of natural gas demand and price. This past week’s hotter than normal weather was a positive short-term catalyst for natural gas and also natural gas producers, though prices traded lower on inventory figures. Hotter weather later in the summer could boost natural gas prices.