China’s interbank lending rate falls below 6.0%, positive for dry bulk shipping?

Update to Must-know: Shipping companies hit by China’s financial woes The impact of China’s financial industry The financial industry is an essential part of any economy. Without a stable financial system—one that supplies liquidity to businesses and individuals and bridges the gap between savers and borrowers—an economy can’t function as efficiently and productively as it […]

Nov. 20 2020, Updated 4:47 p.m. ET

Update to Must-know: Shipping companies hit by China’s financial woes

The impact of China’s financial industry

The financial industry is an essential part of any economy. Without a stable financial system—one that supplies liquidity to businesses and individuals and bridges the gap between savers and borrowers—an economy can’t function as efficiently and productively as it could. So, a collapse in the financial industry would grind an entire economy to a halt.

Central bank and cash crunch

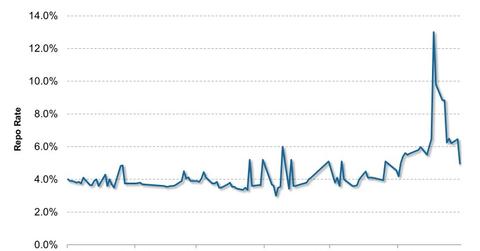

China’s interbank three months repo rate reflects the interest that banks charge each other for borrowing cash for three months in exchange for securities such as government bonds. On July 2, 2013, the rate, expressed in annual terms, fell to 4.95% from 6.45% a day earlier and a record 13% on June 20. It took just 20 days, from the end of May to June 20, for the rate to move up 800 basis points (8%) to hit 13%—another record over the past four years.

A sharp increase in the repo rate reflects a cash crunch—a condition of high demand or low supply of cash, also known as “liquidity issue,” often tied to over-investment. Often, the central bank can intervene by purchasing securities from banks, which increases the cash reserve and liquidity of banks while lowering the repo rate. However, central banks will sometimes let rates stay high to punish banks that irresponsibly issue loans that may be uncollectible in the future, as well as companies that over-invest, anticipating that the central bank will bail them out in the end and create a bubble along the way.

This is likely what we’re seeing right now: rates have fallen from a record high, as China expressed openness to fine-tuning its monetary policy last week, but the fact that the rate remains considerably above the average of 4.0% is negative and suggests conditions within the financial sector are more stressful compared to a few months ago. It’s also questionable whether the financial system will stabilize right away. Historically, high repo rates (which were also volatile) have followed abrupt increases in repo rates.

Cautious outlook for Chinese economy

This liquidity issue is negative for the Chinese economy (green shade represents lower economic growth in the graph above). When liquidity dries up, companies that rely on banks to run their daily operations—such as paying suppliers and workers as well as purchasing new equipment—will not be able to use banks’ services as usual. As bills go unpaid and purchases are postponed, the economy will fall into a recession or weaker growth.

For dry bulk shipping companies that transport key raw materials such as iron ore, coal, and grain across oceans, this means lower or low shipping rates (visit Shipping Indexes for the latest data on shipping rates outlook). As the majority of shipping expenses are fixed, gross margins, earnings and share prices will fall. Companies such as DryShips Inc. (DRYS), Diana Shipping Inc. (DSX), Safe Bulkers Inc. (SB), Eagle Bulk Shipping Inc. (EGLE) and Navios Maritime Partners LP (NMM) would be hurt in the short and perhaps medium terms.

Investors should review other driver analysis to get a better understanding of the drivers that are currently affecting the dry bulk shipping industry. Some must-reads include Maturing contracts present significant downside for certain shipping firms, Low inflation supports availability of monetary stimulus, positive for shipping stocks, Managers continue to order ships, long-term supply and demand balance favorable, and Soaring housing prices are actually positive for China’s real estate and dry bulk stocks.

To see other key drivers that affect the marine shipping industry, visit our driver page, Marine Shipping. For other industries currently available, see our Home Page.