Eagle Bulk Shipping Inc

Latest Eagle Bulk Shipping Inc News and Updates

Industrials Dry bulk shipping weekly analysis (Part 3: Construction rises)

Continued from Part 2 Ship construction activity Part 2 of this series explains how ship orders can illustrate managers’ expectations for future supply and demand differentials. But new ship orders don’t always translate into new constructions right away. Sometimes, shipping firms specify a particular date of delivery for the new orders. If the delivery date is farther […]

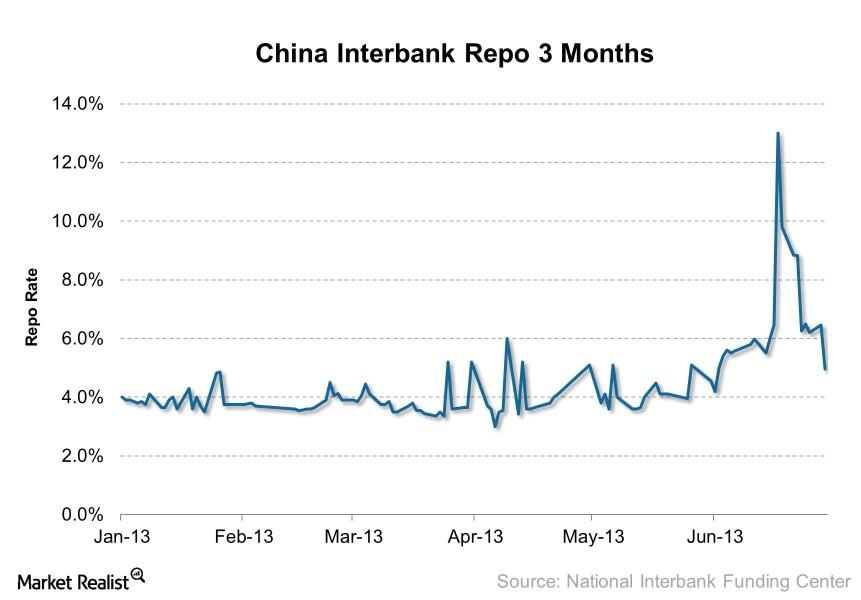

China’s interbank lending rate falls below 6.0%, positive for dry bulk shipping?

Update to Must-know: Shipping companies hit by China’s financial woes The impact of China’s financial industry The financial industry is an essential part of any economy. Without a stable financial system—one that supplies liquidity to businesses and individuals and bridges the gap between savers and borrowers—an economy can’t function as efficiently and productively as it […]

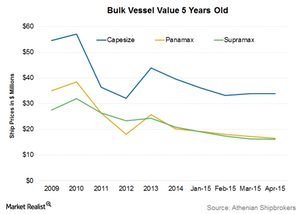

Secondhand Vessel Prices Continue to Fall

Secondhand vessels are delivered faster than newbuilds. As a result, secondhand vessels represent more of the short to medium-term outlook.